The Perpetual Protocol Wars: Why is Hyperliquid Winning?

Quartermaster

3 Jul 2025

The intricate world of financial derivatives traces its origins not to modern trading floors, but to 18th-century Japan, where a samurai faced an urgent need to hedge the value of their payment—rice—against its mercurial price.

To trace those roots, we travel back to 18th-century Japan.

The samurai, Japan’s military nobility, weren’t paid in gold or coin but in rice. Their livelihoods—and their ability to operate—rose and fell with the mercurial price of a single staple crop. A bumper harvest might flood the market and sink prices; a poor one could leave entire clans financially stranded.

This created an urgent need to hedge against future price swings. Enter the Dōjima Rice Exchange in Osaka.

It was here that merchants and samurai began trading in "rice tickets"—early contracts to buy or sell rice at a fixed future price. These rice tickets, formally sanctioned by the Tokugawa Shogunate in 1730, are widely considered the world’s first standardized futures contracts. They allowed rice producers to lock in profits, and risk-hungry speculators to bet on the unknown—laying the conceptual foundation for modern derivatives markets.

Table of Contents

1. A Multi-Trillion Dollar Arena: The Scale of the Modern Derivatives Market

This section covers the basics of the perpetual derivatives ecosystem.

2. The Hyperliquid Phenomenon: Deconstructing the Market Leader

This section breaks down what makes Hyperliquid great.

3. The Contenders: An Investigation into the Competition

This section is a deep dive into the highest volume perpetual derivatives applications. We look at: Hyperliquid, APX Finance, Jupiter, Drift, GMX, dYdX, Helix Perp, GMX, dYdX, Lighter.

4. Navigating the Perpetual Landscape: A Comparative Matrix

This section is a comparative matrix that provides a snapshot of features of all the applications.

5. The Great Debate: CEX vs. DEX in Perpetual Trading

This section breaks down how perp DEXes still currently lag behind CEXes.

6. The Verdict

This section breaks down what the verdict is on the competition between CEXes and perp DEXes.

Conclusion

With that out of the way, let's dive in to the report! 🪂

1. A Multi-Trillion Dollar Arena: The Scale of the Modern Derivatives Market

If we zoom out to the present day, the rice fields of feudal Japan seem worlds apart from today’s sprawling derivatives ecosystem—but the core idea remains unchanged. Today, derivatives form a pillar of global finance, their reach nearly unimaginable in scale. According to the most recent semiannual report from the Bank for International Settlements (BIS), the notional amount of over-the-counter (OTC) derivatives alone stood at over $600 trillion as of the end of June 2024. To put this staggering sum into context:

- It's approximately 5x larger than the total value of all global stock markets combined (estimated around $124 trillion).

- It is nearly 6x more than the combined annual economic output of every country on Earth (global GDP).

- Furthermore, it's over 40x greater than the total combined net worth of all the world's billionaires (around $16 trillion).

This colossal figure underscores the immense importance and pervasive influence of this sector. These instruments are used by corporations, investors, and institutions to manage risk, speculate on future events, and gain exposure to a vast array of assets.

1.1 The New Frontier: Perpetual Swaps in the Crypto Era

Within this vast financial landscape, a new frontier has emerged, driven by the unique architecture of the cryptocurrency markets. This is the era of the perpetual swap, or "perp." Unlike traditional futures contracts, perpetual swaps have no expiration date, making them an ideal match for the round-the-clock, always-on world of crypto markets. A unique mechanism called a funding rate ensures that the contract price stays closely aligned with the real-time spot price.

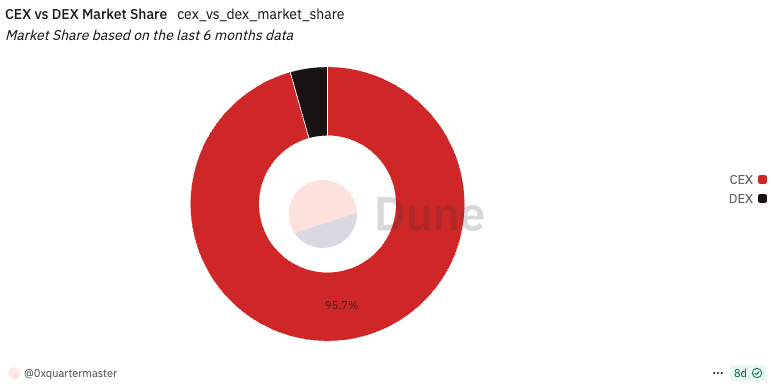

Historically, the trading of these crypto-native derivatives has been overwhelmingly dominated by CEXes. However, a powerful shift is now underway. Driven by a desire for self-custody, transparency, and greater control over assets, a clear migration of trading volume and users is now moving towards on-chain, decentralized alternatives.

However, onchain perp DEXes still occupy only a tiny market share when compared with major CEXes.

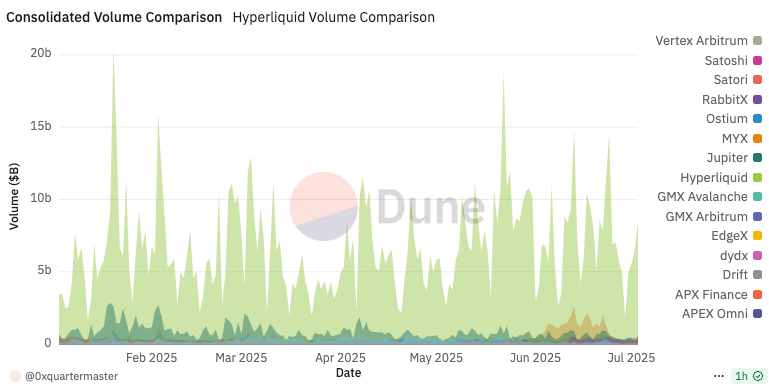

And among all of them, Hyperliquid has notably emerged as the clear leader in trading volume. This sets the stage for a crucial question.

1.2 The Core Question: Why is Hyperliquid Leading the Decentralized Charge?

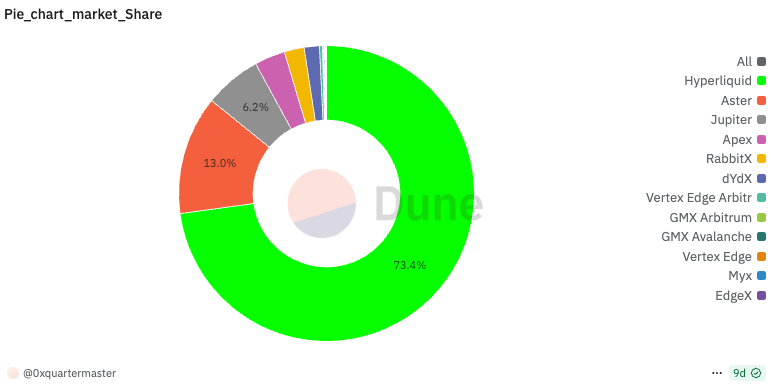

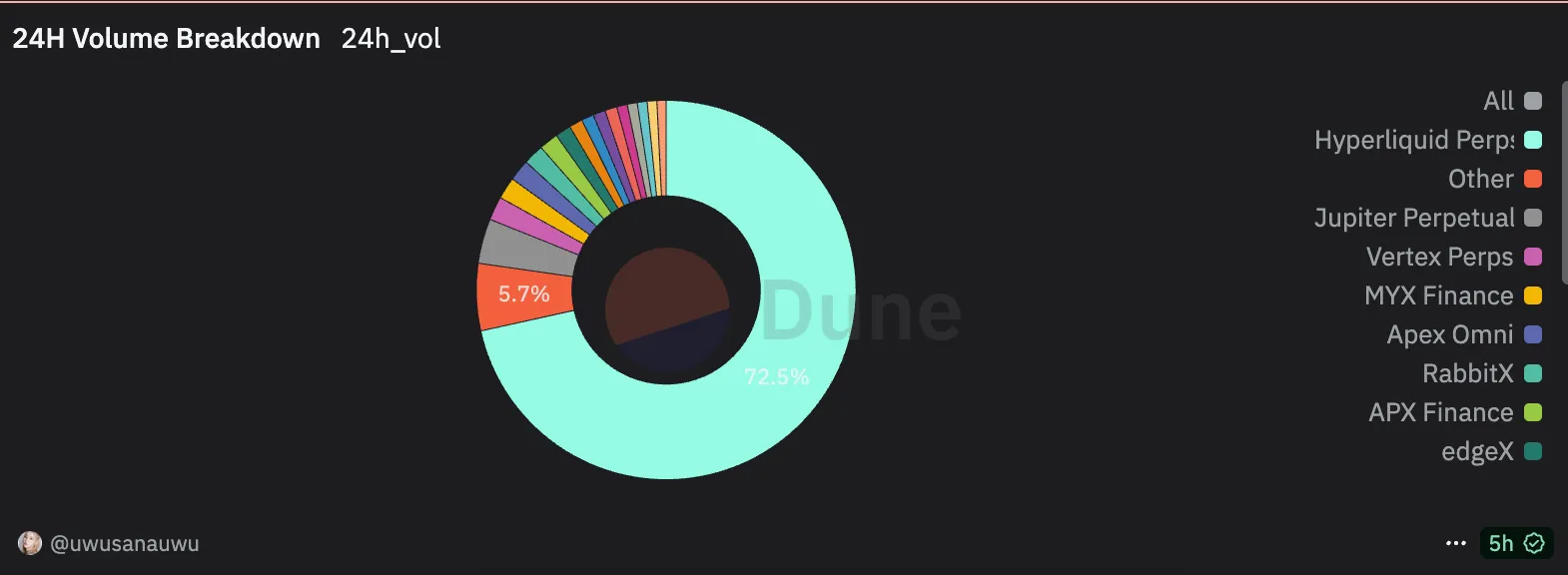

Within the burgeoning decentralized perpetuals market, Hyperliquid has not just emerged as a leader, but has achieved a pronounced dominance, capturing over +67% (as of writing) of the trading volume in this niche.

This significant lead and the somewhat lopsided market share raise a crucial and very pertinent question:

is Hyperliquid's success simply a case of it being 'just too good’?

Or are the competitors just too bad?

These are precisely the questions we aim to tackle in this report.

1.3 Our Investigative Approach: A Search for Answers

This article is an investigation—an attempt to peel back Hyperliquid and see what lies beneath. Our goal isn’t just to describe what’s happening, but to investigate why. We address critical questions:

- What specific features—like its custom-built Layer-1 chain, on-chain order book, or gasless transactions—make Hyperliquid so effective and “sticky” for users?

- Why are long-standing competitors like dYdX and GMX, once the gold standard in DeFi perps, seeing such steep declines in market share? Are they out-innovated, poorly incentivized?

- Perhaps most crucially: Is Hyperliquid’s success sustainable, or is it the product of momentary buzz? Deep research from firms like OAK Research offer one view—but we’ll explore others.

This investigation provides clear, data-backed answers to the most critical questions in the decentralized perpetuals market today. By analyzing the data and comparing the leading protocols side-by-side, this report will uncover exactly why Hyperliquid is winning and, most crucially, whether its dominance can last.

2. The Hyperliquid Phenomenon: Deconstructing the Market Leader

Hyperliquid is leading the decentralized perpetuals market, reportedly capturing over 67% (as of writing) of the trading volume in this niche. But why is it so far ahead?

Is Hyperliquid just too good?

Or are the competitors just too bad?

We start this investigation with these questions in mind. This section builds a lens, examining what truly defines a top-tier derivatives platform:

- from the essentials like liquidity depth and low latency,

- to crucial aspects such as market maker incentives, and then

- we'll put Hyperliquid under the microscope to see how it measures up.

2.1 What makes a good derivatives protocol?

Traders are drawn to derivatives protocols that offer a seamless, efficient, and reliable trading experience. Several key "constituents" determine the quality and attractiveness of a derivatives platform. Among these, two factors play a particularly critical role:

- the depth of the market, facilitated by robust market-making, and

- the clear visibility of order information.

Depth of Market and Market Maker Activity

A primary determinant of a protocol's strength is its liquidity depth, which refers to the ability of a market to absorb large orders without significant price changes. Deep liquidity ensures that traders can enter and exit positions at their desired prices with minimal slippage.

Market makers (MMs) are crucial for providing this liquidity by constantly placing buy and sell orders. They provide liquidity by constantly quoting bid and ask prices, profiting from the bid-ask spread.

Therefore, a good application must create an environment where MMs can effectively make money, thus incentivizing them to provide continuous liquidity. This relationship is symbiotic: MMs need active traders (market takers) to generate volume and profit from the spread, while traders need market makers for liquidity and efficient price discovery.

Orderbook Transparency

Essential for traders is the clear visibility of the current bid and ask prices for an asset. This transparency, often provided through an orderbook formed by the buy and sell orders placed by participants like MMs, allows traders to assess market conditions accurately and make informed decisions, contributing to efficient price discovery.

It's also important to acknowledge the role of "dark pools," particularly in traditional finance. While transparency is generally beneficial, an excessive degree of it can sometimes be detrimental, especially for market makers whose strategies might be exposed or large orders targeted. Some market takers may seek to exploit full orderbook visibility to the disadvantage of liquidity providers. The nuances of these alternative liquidity venues and the balance of transparency will be addressed in a later section of this report.

While the above are paramount, other factors are also highly significant for a top-tier derivatives platform.

Latency of the Trading Engine

Latency is the delay between a trader placing an order and the order being executed. Low latency is critical, especially for high-frequency traders, as even milliseconds can impact profitability. Modern derivatives market makers require ultra-low latency data feeds and optimized order matching engine connectivity. Protocols that can process a high number of orders per second with minimal delay offer a significant advantage.

Efficient Order Settlement

Traders need assurance that their orders will be settled quickly and accurately. This involves robust matching engines and clearing processes.

Now that we understand at least the core fundamentals of what makes a good perpetuals application, let’s analyze how Hyperliquid fulfills all of the above criteria.

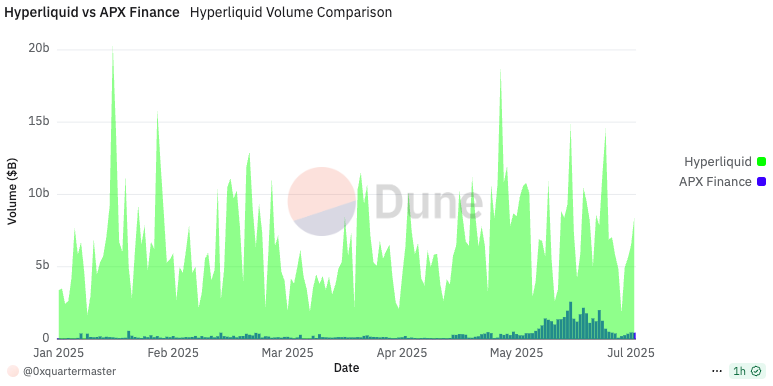

2.2 Hyperliquidity Provider (HLP): Democratizing Market Making

One of Hyperliquid’s most distinctive innovations is the Hyperliquidity Provider (HLP) vault—a protocol-managed system that allows everyday users to participate in liquidity provision, a role traditionally reserved for institutional market makers.

Users can deposit USDC into the vault and receive a proportional share of the profit and loss (PNL) generated by algorithmic strategies operating 24/7 across all listed assets. Rewards are paid in USDC and automatically compounded, making the process both passive and capital-efficient.

In many early-stage DeFi projects, liquidity is bootstrapped through exclusive market-making deals. Hyperliquid takes a different approach. As noted in their official post, core contributors chose to make market-making strategies accessible through a public vault to avoid asymmetric advantages and promote transparency:

“By opening up the HLP and Liquidator vaults, a new standard of transparency and equal access to exchanges is possible.”

According to Nansen, the HLP reported an APR of ~265% at one point—though past performance of the vault does not guarantee commensurate future results.

The fee structure reinforces the protocol’s re-distributive model. Takers typically pay 2.5 basis points (bps), while makers receive a 0.2 bps rebate. Of the net fees, up to 40% can go to an insurance or assistance fund, with the remainder flowing to HLP participants.

Comparing Popular Liquidity Models: Hyperliquid HLP, GMX GLP, and dYdX

To contextualize Hyperliquid's HLP, its distinctive liquidity model is best understood when compared with prominent alternatives, notably from GMX and dYdX, highlighting differing approaches to risk, reward, and participation in decentralized perpetuals.

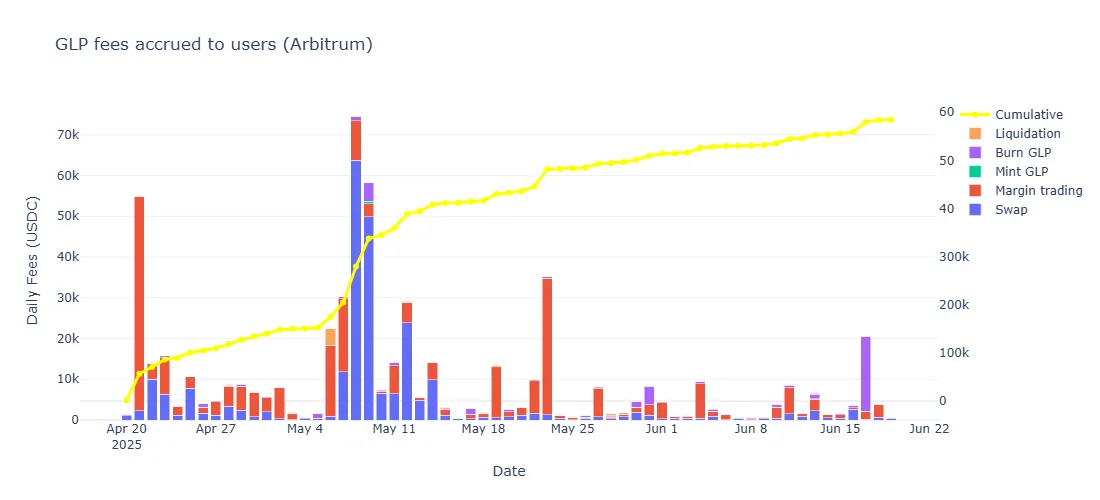

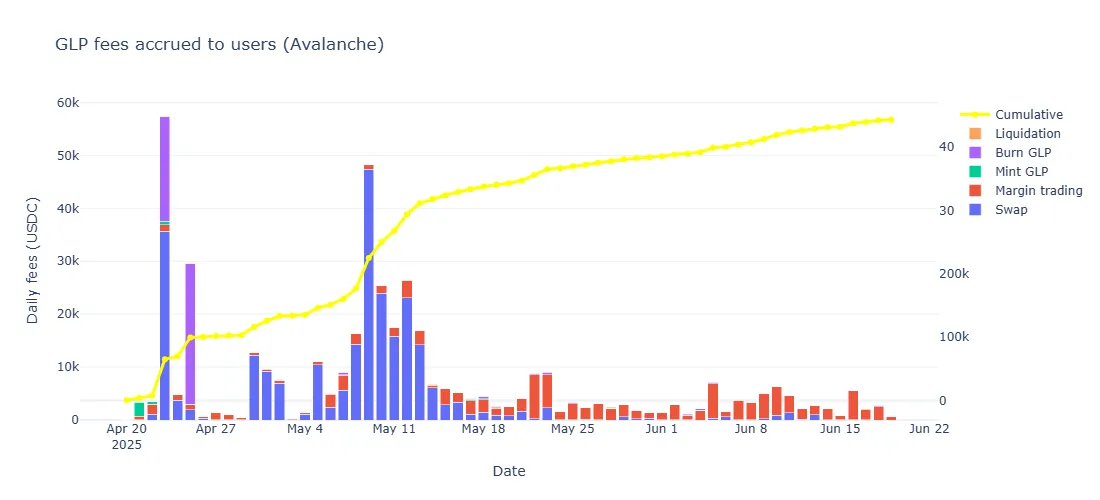

GMX

GMX’s GLP token represents a share in a diverse multi-asset pool (including BTC, ETH, and stablecoins) that underpins the platform's swap and leveraged trading. GLP holders act as the collective counterparty to traders; their profitability is thus tied to trader losses, and they bear exposure to both the price volatility of GLP's underlying assets and the aggregate PnL of traders.

In sharp contrast, Hyperliquid’s HLP allows users to deposit USDC into a vault that executes algorithmic market-making strategies directly on Hyperliquid's on-chain order book. HLP participants earn from strategy PnL and liquidation backstop activities. This USDC-exclusive model confines risk strictly to the performance of these strategies, insulating LPs from external asset price volatility and impermanent loss, while the HLP also plays a key role in market stability through its liquidation mechanism.

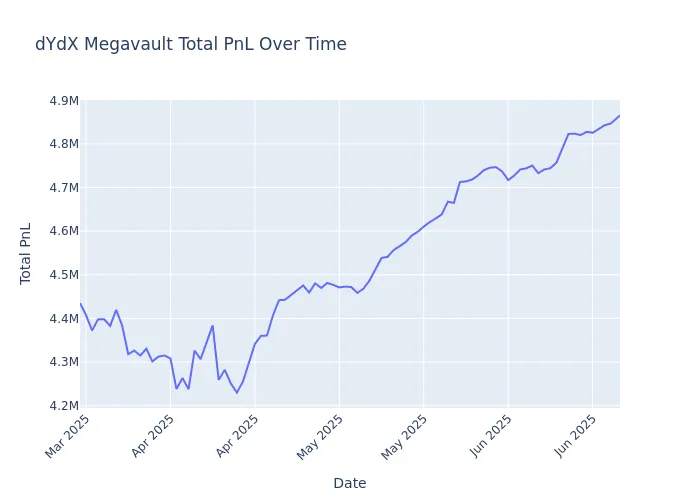

dYdX

dYdX, on the other hand, historically cultivated liquidity by incentivizing professional market makers through rebates and token rewards, without a direct passive LP vault for general users akin to GLP or HLP.

Now, a core component of dYdX Chain's strategy is the active "MegaVault," which allows any user to deposit USDC to provide liquidity and earn yield. This USDC is allocated to automated market-making strategies across various dYdX markets, with returns for depositors potentially coming from PnL on vault positions, funding rates, and trading fee revenue share. This operational feature signifies a shift towards a more accessible and inclusive liquidity model.

Key Distinctions and Trends:

- Hyperliquid HLP: Offers democratized, USDC-based algorithmic market making on an order book, with user risk confined to strategy PnL, avoiding direct asset volatility.

- GMX GLP: Utilizes a multi-asset pool where LPs serve as direct counterparties to traders, sharing dual risks from underlying asset prices and overall trader performance.

- dYdX: Has evolved from a professional MM-centric model to incorporate the operational MegaVault, enabling broad passive USDC liquidity provision and shared PnL from automated strategies.

This evolution, particularly dYdX's integration of MegaVault, underscores a broader DeFi trend: a move from specialist-driven liquidity to more inclusive, user-centric models that strive to balance accessibility, risk, and reward in the dynamic landscape of decentralized derivatives.

While the Hyperliquid team manages strategy design and execution—including pricing and trade logic—this is done transparently through the vault system, not via privileged accounts or opaque routing. The aim is to build a system where users benefit directly from the liquidity they help provide.

To promote protocol stability, HLP deposits include a four-day lock-up period before withdrawals are permitted.

2.3 Where Hyperliquid Stands

Based on the criteria we discussed above:

- Liquidity Depth: The HLP model is designed to bootstrap and maintain liquidity. The success of this model in providing consistently deep liquidity across various market conditions is a key factor in Hyperliquid's performance.

- Latency and Settlement: Its custom Layer-1, HyperBFT consensus, and high order throughput capacity (200K orders/second on HyperCore) demonstrate a strong focus on minimizing latency and ensuring efficient, transparent, on-chain settlement with one-block finality.

- Market Maker Viability: The HLP system aims to make market making accessible and potentially profitable for a broader base of users, rather than relying solely on professional trading firms. The PNL sharing and fee distribution are designed to incentivize participation in the HLP.

Hyperliquid's architecture, with its custom L1, on-chain order book via HyperCore, the HyperEVM for broader ecosystem development, and the innovative HLP system, directly addresses many of the core requirements traders seek in a derivatives protocol. Its incentive programs have further fueled its growth by attracting users and volume. The platform's ability to quickly list new assets also demonstrates adaptability to market demands.

2.4 Incentives and Growth Strategy

Hyperliquid has employed a multi-pronged approach to incentives:

- Initial Rewards: The platform utilized a testnet competition with generous rewards to generate initial interest.

- Trading Volume and Holding Rewards: After the mainnet launch, Hyperliquid introduced cash rewards for trading volume and for holding positions, encouraging active participation.

- Referral Program: A referral system also incentivized user acquisition.

- Rapid Listing of New Assets: Hyperliquid is quick to list perpetual contracts for new and trending assets, often ahead of competitors. This strategy attracts users looking to trade these newer tokens quickly.

- Community-Focused Fee Distribution: Unlike many protocols where fees primarily benefit the team, Hyperliquid directs all fees to the community, specifically to the HLP and an assistance fund, as indicated by its HLP model.

3. The Contenders: An Investigation into the Competition

To truly understand why Hyperliquid has surged to the forefront of the decentralized perpetuals market, it's not enough to analyze its strengths in isolation. We must also investigate why other protocols, despite their own innovations and efforts, are not achieving the same level of dominance. This section puts the competition under the microscope, dissecting their offerings feature by feature. By examining their strengths and, more critically, their weaknesses relative to Hyperliquid, we can build a clearer picture of the current competitive landscape. Our analysis will be structured around a consistent set of key performance metrics critical to any perpetuals protocol:

- Orderbook/Execution,

- Trading Fees,

- Incentive Program,

- Liquidity Depth,

- Asset Variety,

- User Experience (UI/UX), and

- Liquidation Engine.

To provide a clear assessment, each protocol is evaluated against Hyperliquid in a comparison matrix using a specific rating system:

- Better: The competitor's approach is objectively superior to Hyperliquid's.

- Worse: The competitor's approach is objectively inferior or less effective than Hyperliquid's.

- Equally Good: Both protocols offer a high-quality solution, albeit potentially different.

- Different Trade-off: The approaches are not better or worse, but offer different advantages for different types of users.

- Less/More Effective: A specific rating for incentive programs, judging their impact on user acquisition and retention.

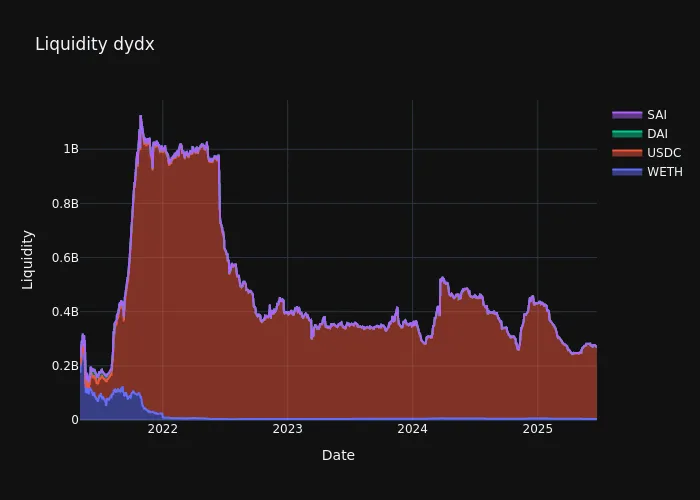

The protocols we compare for this are the top 10 protocols based on the past 30-day market share in trading volume. We use uwusanauwu’s Dune dashboard for this list, which can be found here.

NB: this list gets refreshed based on trading volume so the list you see might be different to the ones we've analyzed below.

3.1 APX Finance

APX Finance is a prominent decentralized exchange for crypto derivatives, operating across multiple major blockchains like BNB Chain and Arbitrum. It uniquely offers both order book (V1) and on-chain perpetuals (V2), aiming to empower a diverse range of traders and stakers with features like high leverage (up to 1001x in specific modes), zero slippage in certain conditions, and competitive fees.

Analysis Based on Key Performance Metrics:

Liquidity Depth

APX Finance approaches liquidity through two distinct models.

- V1 OrderBook Perp: The V1 Order Book Perp is available on multiple chains including BNB Chain, Ethereum, and Arbitrum, adopts an "off-chain transaction matching + on-chain fund settlement and custody" model, aiming for deep liquidity and tight spreads.

- APX V2 On-Chain Perp: This utilizes a fully on-chain liquidity model where the ALP (APX Liquidity Pool) token provides liquidity for all V2 trading pairs. This ALP pool, comprising a basket of assets, acts as the direct counterparty to V2 traders, aiming to maximize capital efficiency. Users contribute to this pool by purchasing ALP tokens with specified assets like USDT, USDC, BTC, etc.

APX V2 claims minimal slippage: 0.01% for its classic mode and zero slippage for its Degen Mode. Slippage on V2 can also be dynamically adjusted based on the trading pair's market depth as determined by oracles. Furthermore, the Permissionless DEX Engine allows partners to integrate APX's infrastructure and benefit from the deep liquidity via the ALP pool.

Order Settlement Speed and Latency

APX V1's hybrid model is engineered for high transaction performance and fast response speeds while ensuring fund safety through on-chain settlement.

APX V2, being fully on-chain, relies on a sophisticated multi-oracle system. It combines Pyth Oracle, Chainlink, and Binance Oracle to deduce accurate real-time aggregated prices. Binance Oracle has reportedly provided a customized low-latency solution exclusively for APX to help avoid MEV and front-running. The platform states its price oracle validation process is decentralized and typically completes within two blocks.

Market Makers (LPs) and Profitability

Liquidity provision on APX V2 is centered around the ALP token. Users become LPs by minting ALP using assets like: USDT, USDC, DAI, BTC, or ETH.

The Net Asset Value (NAV) of ALP, and consequently its price (initially $1 USD), is influenced by the profit or loss of the pool, income from trading fees, funding fees, and liquidations.

LPs who mint ALP earn from platform fees, which is reflected in ALP's NAV (referred to as Fee APY). Additionally, ALP minted on BNB Chain can be staked on APX Finance to earn $APX rewards (Stake APY); however, active staking rewards for ALP on Arbitrum, opBNB, and Base are not currently offered directly on APX, though Arbitrum ALP staking is incentivized via PancakeSwap Syrup Pools as part of specific promotions. Users can also stake $APX tokens in the DAO to receive more $APX.

Historical values for the ALP pool on BNB Chain (BSC) are available in quarterly snapshots, showing consistent growth:

| Date | ALP Value (BSC) |

|---|---|

| Apr 2023 | $8M |

| Jul 2023 | $13M |

| Oct 2023 | $13M |

| Jan 2024 | $17M |

| Mar 2024 | $20M |

This table illustrates the steady increase in the net asset value of the BSC ALP pool, driven by platform growth and fee generation.

Head-to-Head: APX Finance vs. Hyperliquid Comparison Matrix

| Feature / Aspect | APX Finance's Approach | Hyperliquid's Approach | Comparative Rating |

|---|---|---|---|

| Orderbook/Execution | V1: Off-chain matching, on-chain settlement. V2: On-chain via ALP pool (counterparty liquidity) & multi-oracle pricing (Pyth, Chainlink, Binance). | Fully on-chain orderbook (HyperCore) on a custom L1. | Different Trade-off |

| Trading Fees | V1: 0.02% maker, 0.07% taker. V2 Classic: ~0.05%-0.08% open/close fees (chain dependent) + execution fee (chain dependent, e.g., 0.5 USD on BNB). <br> V2 Degen: 0 open fee, dynamic PnL-based close fee (min 0.03%). | Taker: 0.045% (VIP 0, under $5M volume); Maker: 0.015% (VIP 0). VIP tiers offer lower fees for higher volumes. | Worse |

| Incentive Program | Long-term $APX token emissions (trading, LPing over 10 yrs). $ARB Incentive Season (volume tiers, lucky airdrops, ALP staking on Arbitrum via PancakeSwap). <br> DEGEN inscriptions airdropped to liquidated V2 traders. | Points for trading activity, referrals, past cash rewards for volume/holding. | Less Effective |

| Liquidity Depth (Majors) | V1: Order book with "tight spreads and deep liquidity". V2: Centralized ALP pool per network (BNB, Arbitrum, opBNB, Base) acts as counterparty. | HLP vault (USDC deposits) for democratized, protocol-managed algorithmic market making directly on the orderbook across all assets. | Different Trade-off |

| Asset Variety | V1: >95 markets. V2: >30 crypto & forex markets. <br> Includes unique MAD (synthetic high volatility) contracts for BTC, ETH, CAKE. | Rapid listing of new and trending assets, reportedly 100+ assets available. (Note: "100+ available assets" is from the example matrix provided in the prompt) | Worse |

| User Experience (UI/UX) | Separate V1 & V2 trading interfaces. Standard Web3 wallet connection. Offers Degen Mode for simplified high-leverage trading. | Custom L1 designed for CEX-like speed, high order throughput (200,000 orders/second), one-block finality, and potentially gasless transactions. Unified experience. | Worse |

| Liquidation Engine | Standard liquidation price calculation. Liquidated V2 traders receive DEGEN inscription airdrops to their BSC address. | HLP vault acts as a liquidation backstop, with PnL from such activities shared with HLP depositors. | Different Trade-off |

Analysis of Findings & Critical Weaknesses:

The comparison between APX Finance and Hyperliquid reveals distinct strategic choices and philosophies.

- Orderbook/Execution (Different Trade-off): APX V1's hybrid "off-chain matching + on-chain settlement" model is designed for performance and fund safety. APX V2 operates entirely on-chain, with the ALP pool serving as the liquidity counterparty and prices derived from a multi-oracle system. This contrasts with Hyperliquid’s fully on-chain order book on its custom L1 (HyperCore), which prioritizes transparent, high-speed execution akin to centralized exchanges. Trading against the ALP pool in APX V2 is fundamentally different from trading against other market participants in Hyperliquid's order book. APX's reliance on external oracles for V2, while robust with multiple sources, introduces different trust assumptions and potential latency vectors not present in Hyperliquid's native L1 execution environment.

- Trading Fees (Worse): APX Finance's fee structures generally appear less competitive. V1 taker fees are 0.07%, and V2 mode fees range from approximately 0.05% to 0.08% for opening and closing, plus an additional execution fee (e.g., 0.5 USD on BNB Chain, 0.2 USD on Arbitrum). Hyperliquid reports significantly lower fees with takers at ~0.045% and rebates for makers. While APX's V2 Degen Mode features a zero opening fee, it incorporates a dynamic PnL-based closing fee with a minimum of 0.03%, which can still exceed Hyperliquid's taker fees. Consistently higher trading costs can significantly impact trader profitability and serve as a deterrent.

- Incentive Program (Less Effective): APX Finance utilizes long-term $APX token emissions for trading and liquidity provision, spread over a decade. It also runs targeted campaigns like the "$ARB Incentive Season" to boost activity on specific chains, involving tiered volume rewards, lucky airdrops, and ALP staking opportunities on partner platforms like PancakeSwap. While comprehensive, these may be perceived as less direct or immediate compared to Hyperliquid’s reported model of points and cash rewards tied directly to ongoing trading volume and holding activities, which can foster more rapid user acquisition and sustained engagement. The DEGEN inscription airdrop for liquidated traders on APX V2 is a novel retention/compensation mechanism but is reactive.

- Liquidity Depth (Majors) (Different Trade-off): APX V1 boasts "tight spreads and deep liquidity" for its order book. In V2, the ALP pool is the central source of liquidity on each supported network, meaning LPs in the ALP pool effectively become the counterparty to traders, sharing in profits or losses. The success of this model depends heavily on the capitalisation and risk management of the ALP pools. Hyperliquid's HLP vault, into which users deposit USDC, facilitates protocol-managed algorithmic market-making strategies directly on its on-chain order book across all listed assets. This approach democratizes market-making and directly contributes to order book depth, a different paradigm to APX's user-funded counterparty pool.

- Asset Variety (Worse): APX V1 lists over 95 markets, and V2 offers over 30 crypto and forex markets, including unique synthetic high-volatility "MAD" contracts for BTC, ETH, and CAKE. However, Hyperliquid is noted for its strategy of rapidly listing a broader range of new and trending assets (reportedly over 100), which can be more appealing to traders seeking early exposure to emerging tokens. While APX's MAD contracts are innovative, they likely cater to a more niche segment of traders.

- User Experience (UI/UX) (Worse): The provision of two distinct trading interfaces for V1 and V2 might introduce complexity for users. While functional, APX relies on standard Web3 wallet connections. Hyperliquid's custom Layer-1 architecture is specifically engineered to deliver a user experience closer to that of a centralized exchange, emphasizing high-speed order processing (200,000 orders/second on HyperCore), one-block finality, and the potential for gasless transactions. This focus on performance can offer a significantly more streamlined and responsive trading environment.

- Liquidation Engine (Different Trade-off): APX Finance employs a standard liquidation price calculation mechanism. A unique feature is the airdrop of DEGEN inscriptions to the BSC wallets of traders whose V2 positions are liquidated, regardless of the chain where liquidation occurred. In contrast, Hyperliquid’s HLP vault also functions as a liquidation backstop, with profits and losses from these activities being shared among HLP depositors. This integrates liquidity provision with market stability in a different manner than APX's approach.

In summary, APX Finance's critical weaknesses relative to Hyperliquid seem to stem from its potentially higher and more complex fee structures, an incentive model that may be less direct in driving continuous, high-velocity trading, and a user experience that, while versatile with V1/V2 options, may not match the specialized performance and CEX-like feel of Hyperliquid's custom L1 solution.

The segmentation of its products and liquidity across different versions and chains could also dilute its competitive impact compared to Hyperliquid's more unified platform.

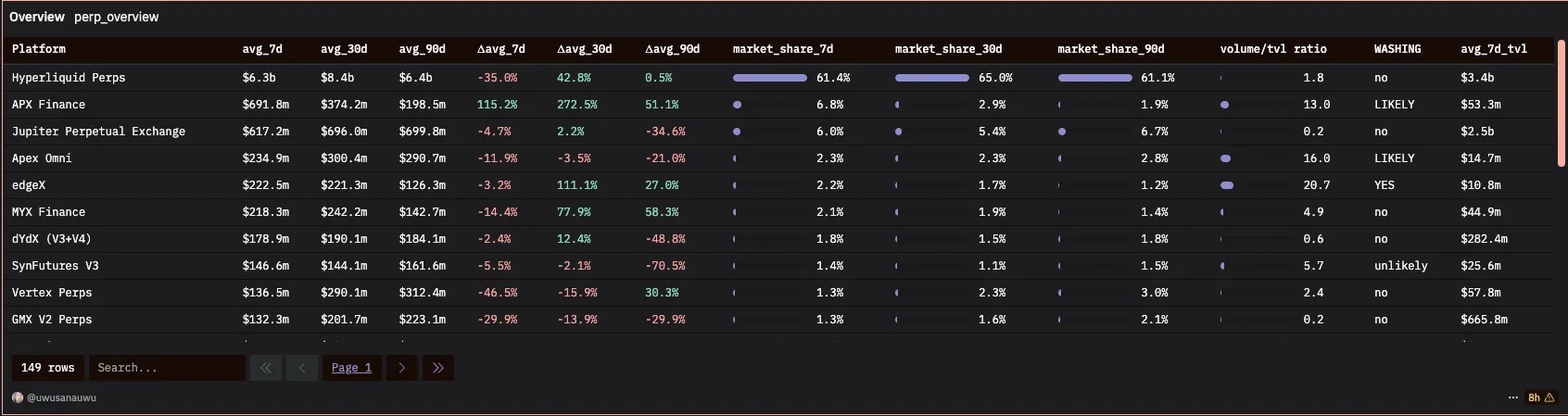

Trading Volume & OI Comparison with Hyperliquid

Incentives & Community Sentiment:

APX Finance has a multi-faceted incentive strategy:

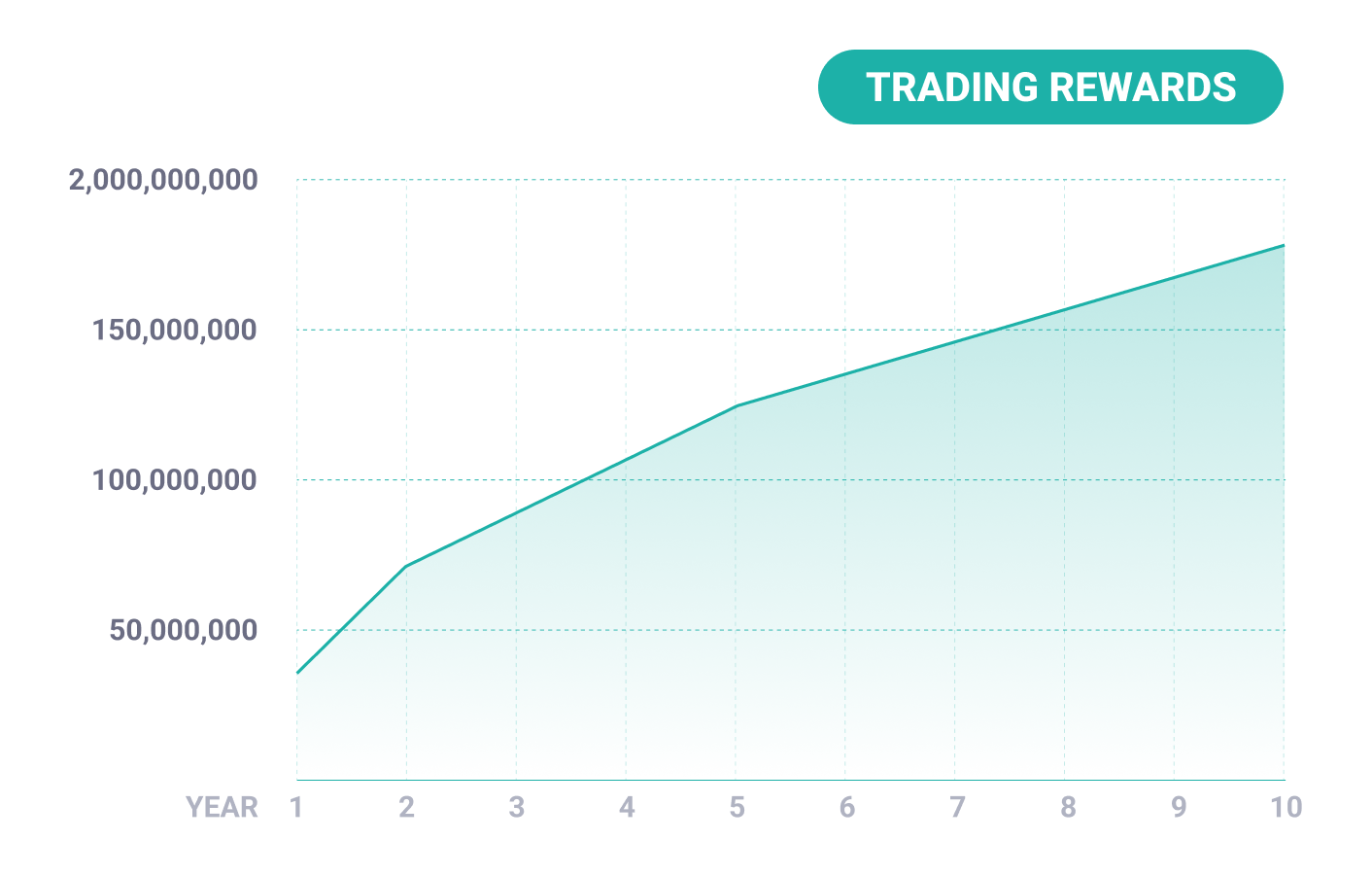

- $APX Token Rewards: A core component is the distribution of $APX tokens over a 10-year period to users for trading activities (1.8 billion $APX) and to liquidity providers (164.25 million $APX).

- DAO Staking: Users can stake their $APX tokens in the DAO to earn additional $APX rewards.

- ALP Staking (Platform Specific): Staking ALP from the BNB Chain pool on APX earns $APX.

- Promotional Campaigns: APX Finance runs significant promotional events, such as the "$ARB Incentive Season" on Arbitrum, which allocated 525,000 $ARB tokens to reward users.

- DEGEN Inscriptions Airdrop: Liquidated traders on APX V2 and SDK partner platforms automatically receive "DEGEN" BRC-20 inscriptions to their BSC wallet, with the amount based on liquidation size. These are tradable on inscription marketplaces like evm.ink.

- Fee Benefits: The Degen Mode on V2 offers a 0 opening fee, and the platform highlights earning trading rewards.

APX Finance has also undertaken a significant token burn of 5.755 billion $APX in April 2022 to enhance token value. A strategic merger with Astherus was announced, with plans to map the $APX token to a new Astherus Token and update tokenomics.

The active campaigns on platforms like Galxe and the detailed structure of the $ARB Incentive Season suggest efforts to engage the community directly. The platform's vision includes exploring user-centric metrics. However, the complexity arising from multiple products (V1, V2), various incentive mechanisms spread across different chains and partner platforms, and postponements in strategic updates like tokenomics could dilute community focus and enthusiasm compared to platforms with a more singular, rapidly evolving narrative like Hyperliquid.

3.2 Drift Trade

Drift Protocol is a perp DEX on the Solana blockchain, offering spot and perpetuals trading, borrowing and lending, and passive liquidity provision through its Backstop AMM Liquidity (BAL) product.

It aims to combine the speed and efficiency of centralized exchanges with the transparency and self-custody of DeFi by utilizing a hybrid model of Just-in-Time (JIT) auction liquidity, a decentralized orderbook (DLOB), and an AMM backstop. This AMM backstop functions as a secondary, on-chain liquidity pool that guarantees trade execution by providing liquidity if the primary, often off-chain, order book fails or is unavailable, ensuring the protocol remains operational at all times. Drift emphasizes robust, computationally efficient design to incentivize market maker participation and provide deep liquidity.

Analysis Based on Key Performance Metrics:

Liquidity Depth: Drift employs a multi-faceted approach to liquidity:

- Just-in-Time (JIT) Auction Liquidity: Market orders are routed through a short-term auction (default 5 seconds) where market makers bid to fill the order, aiming to provide deep liquidity at or better than the auction price.

- Limit Orderbook Liquidity (DLOB): A decentralized orderbook composed of limit orders placed by makers, which can be filled by takers. Keeper bots sort these on-chain limit orders into an off-chain orderbook view and submit orders for filling against the AMM or matching taker orders.

- AMM Liquidity: Drift's virtual AMM (vAMM) acts as a backstop liquidity provider if orders are not filled by JIT auctions or the DLOB. The AMM features an inventory-adjusted spread and oracle-live pricing.

- Backstop AMM Liquidity (BAL): Users can provide liquidity to selected markets by adding shares to the AMM, increasing its depth and earning a share of taker fees. This layered approach is designed to ensure constant liquidity and support for new markets without sole dependence on external market makers. Slippage tolerance can be set by users for market orders.

- Order Settlement Speed and Latency: Drift is built on the Solana blockchain, known for its high throughput and low latency.

- Hybrid Model: Trades are supported by JIT auctions, a DLOB, and an AMM. Limit orders are placed on-chain, while keeper bots manage the off-chain orderbook and trigger execution.

- JIT Auctions: Market orders go through a default 5-second Dutch auction where market makers compete to fill them.

- Matching Engine: Every taker order has auction parameters (duration, start/end price). Keepers and market makers race to fill user orders, with backstop liquidity from the AMM compared before each fill.

- Swift Protocol (Beta): Drift has introduced Swift Protocol, designed for sub-second fills, better prices, and gasless trading by broadcasting orders directly to keepers and market makers, removing the need to wait for Solana block confirmations for certain interactions.

- Oracles: Drift uses Pyth as its primary oracle for spot reference prices for its AMM and for mark prices in perpetuals. For Prelaunch markets without an external oracle, Drift uses the mark TWAP as the oracle price.

- Market Makers (LPs) and Profitability: Drift incentivizes market maker participation through several mechanisms:

- JIT Liquidity Provision: Market makers participate in auctions to fill taker orders and can earn rebates for filling these orders.

- DLOB Keepers: Keeper bots that fill limit orders against the AMM or match taker orders earn a portion of the taker fee.

- Backstop AMM Liquidity (BAL): Users providing liquidity to the AMM (BAL providers) take on a share of the AMM's positions and earn a pro-rata share of 80% of the taker fees collected by the AMM. These fees are reflected as an improved cost basis for the positions they acquire. LPs can also use leverage.

- Fee Structure: Drift has a tiered fee structure based on 30-day trading volume or Insurance Fund Stake. Maker fees can be rebates (e.g., -1 bps), while taker fees vary by tier (e.g., 3 bps to 10 bps for perps). Certain markets like SOL, BTC, and ETH perps have a -75% fee adjustment (discount).

- Maker Rebate Fees: Makers placing 'Post-Only' limit orders can earn rebates. The standard maker fee is -1bps (rebate).

Head-to-Head: Drift Trade vs. Hyperliquid Comparison Matrix

| Feature / Aspect | Drift Trade's Approach | Hyperliquid's Approach | Comparative Rating |

|---|---|---|---|

| Orderbook/Execution | Hybrid: Just-in-Time (JIT) auctions, Decentralized Orderbook (DLOB) with off-chain keeper sorting and on-chain settlement, AMM backstop. Built on Solana. Swift Protocol (beta) for faster fills. | Fully on-chain orderbook (HyperCore) on a custom L1. | Different Trade-off |

| Trading Fees | Tiered: Maker rebates (e.g., -0.01%). Taker fees vary (e.g., 0.03%-0.10% for perps, Tier 1 is 0.10%). Major pairs (SOL, BTC, ETH perps) have -75% fee discount. Spot fees differ (e.g., Tier 1: -0.02% maker, 0.05% taker). | Taker: 0.045% (VIP 0, under $5M volume); Maker: 0.015% (VIP 0). VIP tiers offer lower fees for higher volumes. | Worse |

| Incentive Program | FUEL points for DRIFT staking and trading volume (Taker: 1 FUEL/$1, Maker: 1 FUEL/$1). Milestone-based DRIFT token allocation campaign (Season 1 until June 2025). Activity boosters. | Points for trading activity, referrals. Past cash rewards for volume/holding. | Less Effective |

| Liquidity Depth (Majors) | Multiple liquidity sources: JIT auctions by MMs, DLOB (resting limit orders), AMM, and Backstop AMM Liquidity (BAL) provided by users. | HLP vault (USDC deposits) for democratized, protocol-managed algorithmic market making directly on the orderbook across all assets. | Different Trade-off |

| Asset Variety | Offers spot and perpetuals. Supports various crypto assets including SOL, BTC, ETH, and others like APT, BONK, PEPE, JUP, WIF etc.. Also lists Prelaunch markets. | Rapid listing of new and trending assets, reportedly 100+ assets available. | Worse |

| User Experience (UI/UX) | Standard Web3 wallet connection on Solana. Offers Lite Mode for simplicity. Swift Protocol (beta) aims for gasless trading and instant execution. Supports multiple subaccounts. | Custom L1 designed for CEX-like speed, high order throughput (200,000 orders/second), one-block finality, and potentially gasless transactions. Unified experience. | Worse |

| Liquidation Engine | Based on account-level cross-margin. Liquidations occur when totalCollateral < maintenanceMarginRequirement. Liquidators take over positions at oracle price plus penalty/fee. Insurance Fund as backstop; socialized losses if depleted. | HLP vault acts as a liquidation backstop, with PnL from such activities shared with HLP depositors. | Different Trade-off |

Analysis of Findings & Critical Weaknesses:

Drift Trade presents a sophisticated platform on Solana, leveraging a complex, multi-layered liquidity model designed to ensure trade execution. This system operates in sequential stages:

- Just-in-Time (JIT) Auctions: When a user places a market order, it is first routed through a JIT auction, a short (typically 5-second) bidding war where market makers compete to fill the order, aiming to provide deep liquidity instantly.

- Decentralized Orderbook (DLOB): If the order is not filled via auction, the system turns to the DLOB, which is composed of standard limit orders placed on-chain by makers. Off-chain "keeper" bots are essential here, as they sort these orders and submit them for matching.

- AMM Backstop: As a final safety net, Drift utilizes a virtual AMM (vAMM) that acts as a liquidity provider of last resort, ensuring trades are filled if JIT and DLOB liquidity are insufficient. Users can also contribute capital to this layer through the Backstop AMM Liquidity (BAL) product to increase its depth.

This intricate system aims for deep liquidity and efficient execution, but its complexity raises questions about its effectiveness compared to Hyperliquid's more straightforward, fully on-chain L1 orderbook. The model's success is highly dependent on the coordination and constant participation of various actors—JIT market makers for auctions and keeper bots for the DLOB. This reliance introduces potential latency vectors and operational risks not present in Hyperliquid's vertically integrated design, where liquidity is concentrated in the single, protocol-managed HLP vault.

Key Points to Note About Drift:

- Trading Fees (Worse): While Drift offers maker rebates (-1 bps) that are better than Hyperliquid's (-0.002%), its taker fees are generally higher and more complex. Drift's base taker fee for Tier 1 perps is 0.10%, significantly higher than Hyperliquid’s 0.045%. Although major pairs on Drift receive a 75% discount, potentially bringing taker fees to 2.5 bps for Tier 1, this applies to a limited set of markets and still involves a tiered structure that can be less transparent and more costly for lower-volume traders compared to Hyperliquid's flat, low fees.

- Liquidity Depth (Majors) (Different Trade-off): Drift’s multi-pronged liquidity strategy (JIT, DLOB, AMM, BAL) is comprehensive but relies on the coordination of various actors and mechanisms.

Drift's critical weaknesses relative to Hyperliquid appear to be its more complex and generally higher trading fee structure, a less direct incentive model for rapid growth, and a user experience that, while improving, may not natively match the specialized CEX-like performance of Hyperliquid’s custom L1. Furthermore, operating within the competitive Solana ecosystem means Drift contends with other DEXs like Jupiter for market share, unlike Hyperliquid, which established its own L1 environment.

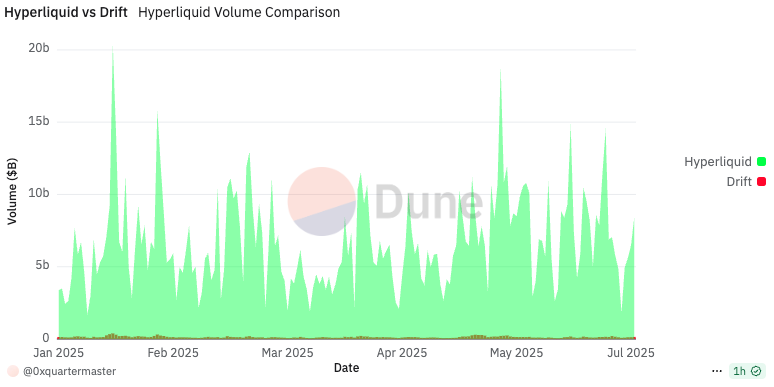

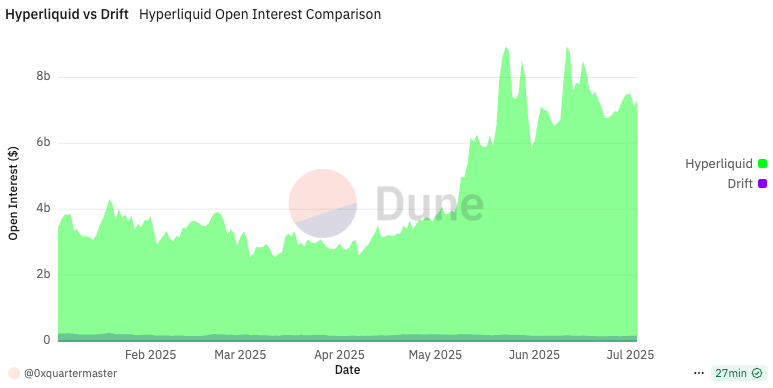

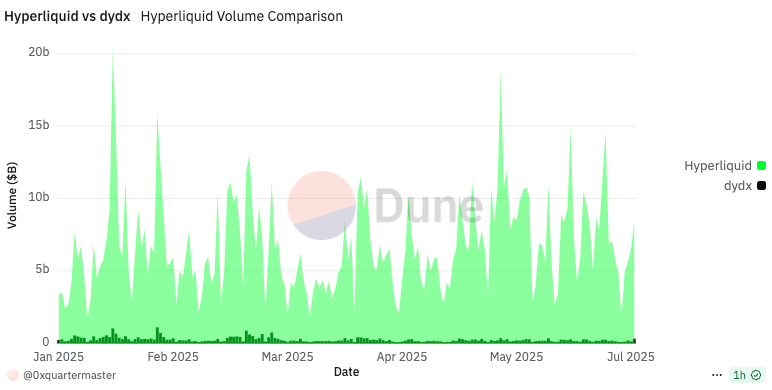

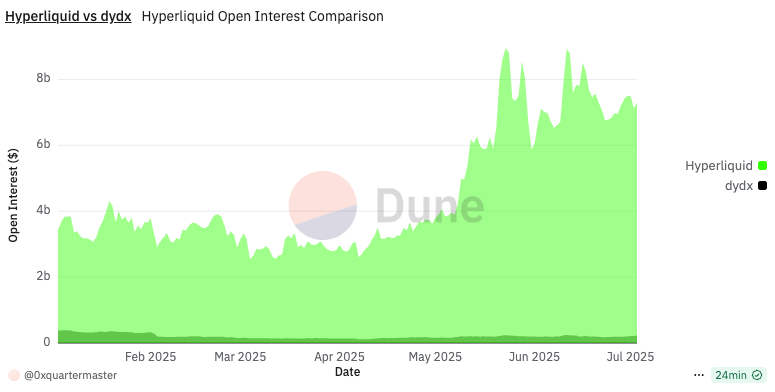

Trading Volume and OI Comparison With Hyperliquid

Incentives & Community Sentiment:

Drift Protocol has implemented several incentive mechanisms:

- FUEL Rewards System: Users earn "FUEL" for activities such as staking DRIFT and trading (both taker and maker volume). For example, DRIFT Staking earns 10 FUEL for every DRIFT staked for 28 days, and both Taker and Maker Volume earn 1 FUEL for every $1 in volume.

- Activity Boosters: These can accelerate the earn rate for different activities.

- Seasonal Campaigns: The "Season 1 Fuel Campaign" proposes allocating up to 7.82% of the total DRIFT supply through a milestone-based campaign concluding in June 2025, with the total DRIFT allocation scaling with Drift's trading volume success.

- Market Maker Program: Drift has a program to attract major crypto market makers via its APIs, which led to a transition from passive to active liquidity. Makers can also receive fee rebates.

- Ecosystem Growth: The Drift team aims to foster an ecosystem, sponsoring hackathons and encouraging building on its permissionless infrastructure.

3.3 GMX

GMX is a decentralized spot and perpetual exchange that initially gained prominence on Arbitrum and Avalanche. It supports trading with low swap fees and aims for low price impact.

It utilizes multi-asset pools (GLP for V1, GM/GLV for V2) that reward liquidity providers with fees from market making, swaps, and leverage trading. GMX employs dynamic pricing through Chainlink Oracles and an aggregation of prices from leading volume exchanges.

- GMX V2 (GM/GLV Pool LPs): LPs earn 63% of platform fees. The price of GM/GLV tokens is designed to increase as fees from leverage trading and swaps are accrued. Profitability is linked to trader performance and the balance of long/short positions. Risks include counterparty risk, token risks, and potential imbalances leading to ADL (Auto-Deleveraging) in synthetic markets. For example, if a pool backing a synthetic asset (e.g., DOGE backed by ETH-USDC) sees extreme price moves in the synthetic asset not mirrored by the backing assets, profits for traders could exceed the pool's backing, triggering ADL.

- GMX Token Stakers: Staked GMX earns GMX rewards (V1) or a share of protocol revenue (V2). In V1, stakers received 30% of platform fees. In V2, this was adjusted to 27%. Rewards for stakers are funded by a buyback mechanism using swap and leverage trading fees.

Head-to-Head: GMX vs. Hyperliquid Comparison Matrix

| Feature / Aspect | GMX's Approach | Hyperliquid's Approach | Comparative Rating |

|---|---|---|---|

| Orderbook/Execution | V1: Liquidity pool (GLP) + oracle pricing. No orderbook. Trades execute against GLP. V2: GM/GLV pools + oracle pricing (Chainlink Data Streams). Execution by Keepers. Supports market, limit, stop, TWAP orders. | Fully on-chain orderbook (HyperCore) on a custom L1. | Different Trade-off |

| Trading Fees | V1: 0.1% open/close fee. Hourly borrow fee. Swap fees 0.2%-0.8%. V2: Open/close fee 0.04%-0.07% (depending on balance impact). Swap fees 0.05%-0.07% (stablecoin swaps lower). Price impact fees. Funding and borrowing fees. | Taker: 0.045% (VIP 0, under $5M volume); Maker: 0.015% (VIP 0). VIP tiers offer lower fees for higher volumes. | Worse |

| Incentive Program | GMX staking for GMX rewards and Multiplier Points (V1, MPs later sunset). esGMX rewards for LPs and stakers, vestable over 1 year. No direct trade mining like dYdX. | Points for trading activity, referrals. Past cash rewards for volume/holding (e.g., $1 for $10k volume). | Less Effective |

| Liquidity Depth (Majors) | V1: GLP multi-asset pool acts as counterparty; depth dependent on GLP size and composition. V2: GM/GLV individual pools; depth per pool, influenced by long/short token balance and OI. | HLP vault (USDC deposits) for democratized, protocol-managed algorithmic market making directly on the orderbook across all assets. | Different Trade-off |

| Asset Variety | V1: Limited (BTC, ETH, UNI, LINK, AVAX). V2: Aims to expand with isolated pools, including blue chips, mid-caps, and synthetic assets (e.g., DOGE, LTC). | Rapid listing of new and trending assets, reportedly 100+ assets available. | Worse |

| User Experience (UI/UX) | Web3 wallet connection on Arbitrum/Avalanche. V1 involved slippage and Keeper execution delays. V2 aims for faster execution, lower slippage, more order types. Can be complex with V1/V2, GLP/GM/GLV pools. One-Click Trading available in V2. | Custom L1 designed for CEX-like speed, high order throughput (200,000 orders/second), one-block finality, and potentially gasless transactions. Unified experience. | Worse |

| Liquidation Engine | V1: Position liquidated if (collateral - losses - borrow fee) < 1% of position size. V2: Position liquidated if (collateral - losses - fees) < 0.4%-1% of position size (market/pool dependent). ADL for synthetic markets if profits exceed pool backing. | HLP vault acts as a liquidation backstop, with PnL from such activities shared with HLP depositors. | Different Trade-off |

Analysis of Findings & Critical Weaknesses:

GMX, a prominent name in decentralized perpetuals, operates on a distinct "pool-to-peer" model rather than a central limit orderbook. This presents several trade-offs when compared to Hyperliquid's dedicated L1 orderbook approach.

Key Points to Note About GMX

- Orderbook/Execution (Different Trade-off): GMX does not use a traditional orderbook. In V1, traders trade against the GLP pool, with prices determined by oracles. V2 maintains this oracle-based system with GM/GLV pools and Keeper execution. This model offers zero price impact on V1 (replaced by price impact fees in V2) and aggregated liquidity but can suffer from oracle latency, potential front-running (though GMX has measures against this).

- Trading Fees (Worse): GMX's fees, even in V2 (0.04-0.07% open/close + price impact + funding/borrow fees ), are generally at par or more complex than Hyperliquid's straightforward taker fees of ~0.045% and maker rebates. The multiple fee layers in GMX (open/close, price impact, hourly borrow/funding) can accumulate, making it less cost-effective for very active traders compared to Hyperliquid's simpler, lower fee structure.

- Incentive Program (Less Effective): GMX's incentives focus on rewarding GMX stakers and liquidity providers through esGMX and a share of protocol fees. While this aligns long-term LPs and token holders, it's less direct in stimulating trading volume compared to Hyperliquid’s past cash rewards for trading volume and holding positions, and its ongoing points program which encourages continuous activity. GMX explicitly avoids direct "trade mining" incentives.

- Liquidity Depth (Majors) (Different Trade-off): GMX's liquidity is pooled – in V1, the entire GLP pool serves as the counterparty; in V2, liquidity is segmented into individual GM/GLV pools. Depth is therefore a function of the total value locked in these pools and their composition. While this can provide substantial liquidity for listed assets, it's a different paradigm from Hyperliquid's HLP vault, which directly feeds algorithmic market-making strategies into an on-chain orderbook.

- User Experience (UI/UX) (Worse): Trading on GMX, especially with the V1/V2 distinction and different pool types, can present a steeper learning curve. While V2 aims to improve execution speed and reduce slippage, the fundamental experience of trading against a pool with oracle-determined prices and keeper-based execution differs from the CEX-like feel that Hyperliquid's custom L1 and on-chain orderbook are designed to provide (high throughput, potentially gasless transactions, one-block finality).

- Liquidation Engine (Different Trade-off): GMX employs a standard liquidation mechanism where positions are closed if collateral drops below maintenance margin requirements. GMX V2 also introduces ADL for synthetic markets to ensure pool solvency.

In essence, GMX's critical weaknesses relative to Hyperliquid appear to be its higher and more complex fee structure, a potentially less direct incentive model for driving high-frequency trading volumes, more limited asset variety historically, and a user experience that, while robust for its model, does not replicate the specific high-performance, orderbook-centric feel of Hyperliquid's custom Layer-1 solution. GMX's model is built around its liquidity pools acting as the counterparty, which is fundamentally different from Hyperliquid's CEX-like orderbook matching.

GMX V1 vs GMX V2

GMX V2 was launched in August 2023 as a significant upgrade to address the limitations of its successful predecessor, GMX V1. Despite V2 introducing notable improvements to the protocol's mechanics, it did not immediately capture the majority of trading volume.

Liquidity and Asset Models:

- GMX V1: Operated on a single, unified multi-asset liquidity pool (GLP). This aggregated liquidity model was simple for LPs but had two main drawbacks: it exposed LPs to significant systemic risk from open interest (OI) imbalances, and it severely limited the number of tradable assets, as adding any new, riskier asset would alter the risk profile of the entire pool.

- GMX V2: Replaced the single GLP pool with isolated GMX Market (GM) pools. This change was fundamental. It allows for the listing of a much wider variety of assets, including "Blue Chips" (BTC, ETH), "Mid-cap Assets" (SOL, LINK), and even "Mid-cap Synthetic Assets" (DOGE, LTC) backed by other assets like ETH. By isolating pools, the risk of a single volatile asset impacting the entire protocol is contained. However, this architectural shift introduced a new challenge: liquidity fragmentation. Instead of one deep pool, liquidity is now spread across multiple, smaller GM pools, which can be a disadvantage for traders seeking deep liquidity on a specific pair.

Fee Structures and Risk Incentives:

- GMX V1: Utilized a simple fee model with a 0.1% open/close fee and an hourly borrow fee paid by both long and short positions. Crucially, it lacked a funding rate mechanism. This meant that OI imbalances could not be quickly corrected by arbitrageurs seeking to earn funding, leading to sustained directional risk for GLP providers.

- GMX V2: Implemented a more complex and dynamic fee structure designed to actively manage risk. It reduced the base open/close fee (to 0.04%-0.07%), but introduced two key new mechanisms:

- Funding Rate: The dominant side of a trade pays a funding rate to the weaker side, creating a direct financial incentive for arbitrageurs to balance the open interest.

- Price Impact Fee: To simulate the effect of order book depth, V2 adds a price impact fee that increases with trade size and how much the trade worsens the OI imbalance. This makes it more expensive for large trades to create further imbalance, protecting the LPs. While this new model is more sophisticated in managing risk, its complexity and the introduction of price impact—a departure from V1's zero-impact promise—may have been less attractive to some traders.

Liquidations and Protocol Safeguards:

- GMX V1: Had a straightforward liquidation process but few mechanisms to protect LPs if extreme market events caused massive, unbalanced trader profits, which could potentially drain the GLP pool.

- GMX V2: Introduced Auto-Deleveraging (ADL) for its synthetic markets. ADL serves as a critical backstop. If the profits on a synthetic asset (like DOGE) were to grow so large that they threatened the solvency of the backing asset pool (e.g., ETH), the system can automatically close out profitable positions to ensure the pool can cover all payouts. This protects the protocol but can be a negative experience for profitable traders whose positions are closed prematurely.

In conclusion, while GMX V2 is technologically a more robust and risk-managed protocol, its launch into a market with low volatility and intense competition, combined with its increased complexity and fragmented liquidity model, explains its slower-than-expected initial adoption. The GMX team has prioritized long-term protocol security and infrastructure over short-term, incentive-driven volume, a strategic trade-off that has shaped V2's market reception.

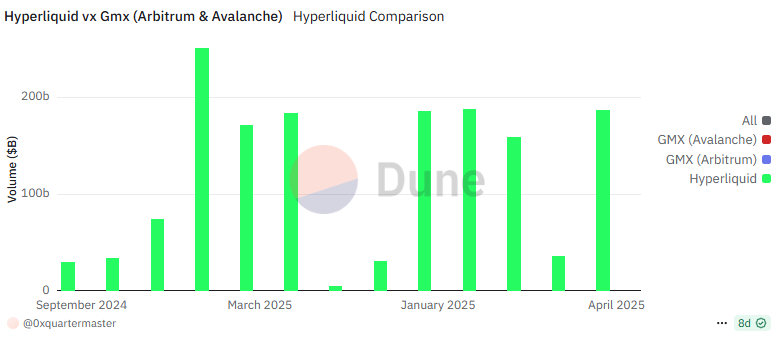

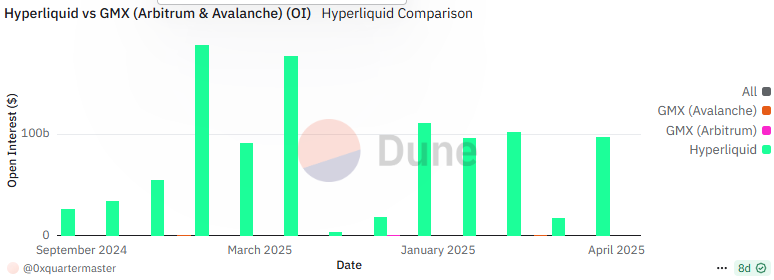

Trading Volume and OI Comparison with Hyperliquid

Incentives & Community Sentiment

GMX's incentive structure is primarily focused on rewarding liquidity providers (GLP/GM holders) and GMX token stakers.

- GMX Token Staking: Stakers of the GMX token earn a portion of protocol fees (30% in V1, 27% in V2) which are bought back as GMX, and Multiplier Points (in V1, later sunsetted) that could boost yield.

- esGMX Rewards: Escrowed GMX (esGMX) has been historically awarded for GMX staking and to GLP holders. esGMX can be staked to earn rewards similar to GMX or vested over one year to become liquid GMX tokens, requiring a proportional amount of GMX or GLP to be reserved during vesting.

- GLP/GM Pool Rewards: Liquidity providers (GLP in V1, GM/GLV in V2) earn the majority share of platform fees (70% in V1, 63% in V2). This "real yield" in assets like ETH or AVAX (for V1 GLP) was a significant attraction.

- No Direct Trading Incentives: GMX does not offer direct incentives for trading volume in the way that dYdX did with its trade mining program, aiming for more organic volume.

Community sentiment towards GMX has generally been positive due to its strong revenue generation and "real yield" narrative. However, concerns about the sustainability of GLP yield (given its exposure to trader PnL), the limitations on asset variety in V1, and the complexity of its fee structures have been points of discussion. The GMX team has been noted for its strong protocol design capabilities. While V2's launch was met with decent performance, the market reaction was described as "lukewarm" initially, attributed to broader market conditions and the lack of aggressive marketing or trading incentives.

3.4 Jupiter Perpetual

Jupiter, primarily known as a leading liquidity aggregator on the Solana blockchain, has expanded its offerings to include perpetual contracts, positioning itself as a significant player in the decentralized derivatives space, particularly within the Solana ecosystem. Its perpetuals product leverages a GMX-style liquidity model through the JLP pool, where users can provide liquidity and act as counterparties to traders.

Analysis Based on Key Performance Metrics:

- Liquidity Depth:

- Jupiter Perpetual sources its liquidity primarily through the JLP pool, a multi-asset pool consisting of SOL, ETH, wBTC, USDC, and USDT. Liquidity providers (LPs) mint JLP tokens by depositing assets into this pool.

- The JLP pool itself acts as the counterparty to traders on Jupiter Perpetual.

- To manage liquidity and compensate LPs, 75% of all fees generated from trading, swaps, and JLP minting/burning are reinvested directly into the JLP pool, aiming to increase its value over time.

- Jupiter Perpetual uses an oracle-based pricing model (aggregating from Edge by Chaos Labs, Chainlink, and Pyth) which means large trades do not directly impact the execution price in the same way as an order book. However, to simulate market dynamics and compensate the JLP pool for taking on directional risk, a price impact fee is implemented.

- The depth of the market is effectively tied to the total assets under management (AUM) in the JLP pool. There's an AUM limit for JLP; if hit, new JLP minting is disabled.

- Order Settlement Speed and Latency:

- Built on the Solana blockchain, Jupiter Perpetual is designed to benefit from Solana's high throughput and low transaction fees.

- It utilizes an on-chain request fulfillment model. Traders submit trade requests (e.g., open, close, deposit collateral) via the UI or API, which creates an on-chain transaction.

- Keepers, which are off-chain services, listen for these on-chain requests, verify them, and then create a second transaction to execute the trade on the blockchain. This two-transaction process (request and fulfillment) is central to its operation.

- In Jupiter Perpetual, keepers are automated off-chain actors that continuously monitor and execute user position requests (such as opening, modifying, or closing leveraged trades) by interacting with the protocol’s smart contracts, using real-time oracle prices to ensure accurate and timely trade execution.

- Prices are derived from a multi-oracle system, with Edge by Chaos Labs as the primary oracle, and Chainlink and Pyth as verification and backup. Oracle price updates occur during trade execution and via regular updates from a dedicated keeper. The system includes checks for stale or deviant oracle prices to ensure accuracy.

- Market Makers (LPs) and Profitability:

- Liquidity providers for Jupiter Perpetual do so by minting JLP tokens, effectively depositing assets into the JLP pool.

- LPs earn 75% of all platform fees (from perpetual trading, swaps, and JLP minting/burning), which are reinvested into the JLP pool, thereby increasing the value of JLP tokens over time.

- Additionally, traders pay hourly borrow fees for leveraged positions, which are also reinvested into the JLP pool, contributing to LP yield. The borrow fee is calculated based on token utilization in the pool and the position size.

- The primary risks for JLP holders include exposure to the price volatility of the underlying assets in the pool (SOL, ETH, BTC) and the counterparty risk to traders (trader profits come from the JLP pool). During strong bull markets where traders are consistently profitable, the JLP pool's value could decrease.

Head-to-Head: Jupiter Perpetual vs. Hyperliquid Comparison Matrix

| Feature/Aspect | Jupiter Perpetual's Approach | Hyperliquid's Approach | Comparative Rating |

|---|---|---|---|

| Orderbook/Execution | Oracle-based pricing (Edge, Chainlink, Pyth) with on-chain request fulfillment by Keepers on Solana. No user-facing order matching. | Fully on-chain orderbook (HyperCore) on a custom L1. | Different Trade-off |

| Trading Fees | Base fee: 0.06% of position amount for open or close. Additional price impact fee and hourly borrow fees. | Taker: 0.045% (VIP 0, under $5M volume); Maker: 0.015% (VIP 0). VIP tiers offer lower fees for higher volumes. | Worse |

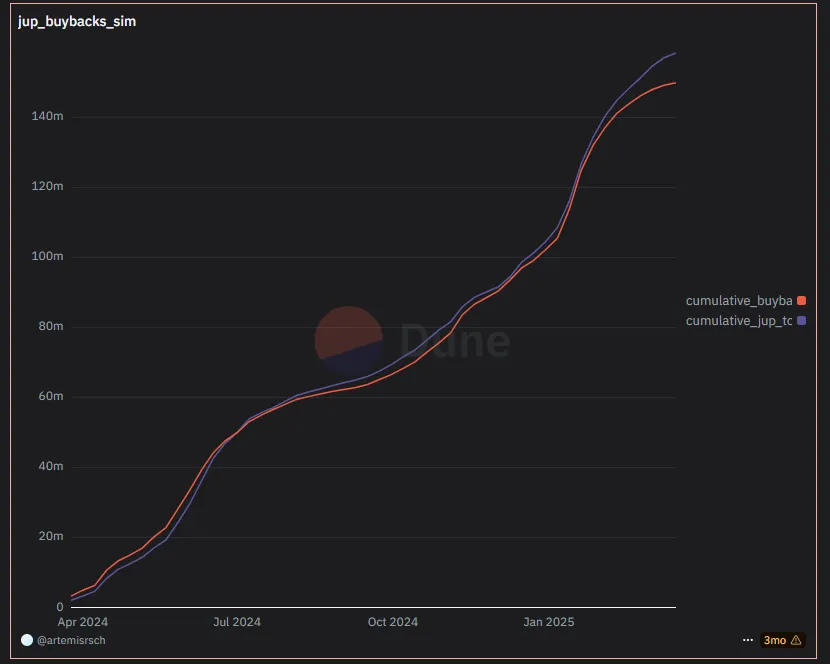

| Incentive Program | JLP holders receive 75% of platform fees. Broader Jupiter ecosystem airdrops (JUP token); 50% of protocol fees for JUP buybacks. No regular direct trading incentives noted. | Points for trading activity, referrals. Past cash rewards for volume/holding (e.g., $1 for $10k volume). | Less Effective |

| Liquidity Depth (Majors) | JLP multi-asset pool (SOL, ETH, BTC, USDC, USDT) acts as counterparty. Depth depends on JLP AUM. | HLP vault (USDC deposits) for democratized, protocol-managed algorithmic market making directly on the orderbook across all assets. | Different Trade-off |

| Asset Variety | Supports SOL, ETH, wBTC perpetuals. | Rapid listing of new and trending assets, reportedly 100+ assets available. | Worse |

| User Experience (UI/UX) | Runs on Solana, execution via Keepers. Limit orders supported. Max 6 open positions (long/short for SOL, wETH, wBTC). Up to 20 limit orders per pair/side. | Custom L1 designed for CEX-like speed, high order throughput (200,000 orders/second), one-block finality, and potentially gasless transactions. Unified experience. | Worse |

| Liquidation Engine | Standard leverage-based liquidation when margin requirements are not met. | HLP vault acts as a liquidation backstop, with PnL from such activities shared with HLP depositors. | Different Trade-off |

Analysis of Findings & Critical Weaknesses:

Jupiter Perpetual presents several distinct differences and potential weaknesses when compared to Hyperliquid's model.

Key Points to Note About Jupiter Perpetual

- Orderbook/Execution (Different Trade-off): Jupiter's oracle-based system with Keeper execution is fundamentally different from Hyperliquid's fully on-chain central limit orderbook (CLOB) on a custom L1. While Jupiter's model can offer deep liquidity via the JLP pool for its supported assets, it doesn't provide the same direct order matching experience or the potential CEX-like low latency that Hyperliquid's HyperCore aims for. The reliance on external oracles and a two-step Keeper fulfillment process may introduce latency or complexities not present in Hyperliquid's integrated L1 execution.

- Trading Fees (Worse): Jupiter's base trading fee of 0.06% per open or close is significantly higher than Hyperliquid's taker fee of ~0.045% (and maker rebate). The addition of a price impact fee and hourly borrow fees on Jupiter can further increase the cost for traders, making Hyperliquid's simpler and lower fee structure more attractive, particularly for active or high-volume traders.

- User Experience (UI/UX) (Worse): While operating on the fast Solana blockchain, Jupiter's UX for perpetuals involves a Keeper-based execution model and specific limitations such as a maximum of 6 open positions across the main pairs and up to 20 limit orders per side.

In summary, Jupiter Perpetual's critical challenges relative to Hyperliquid stem from its generally higher and more layered fee structure, a less direct incentive mechanism for high-frequency trading, more limited asset variety for perpetuals, and a user experience that, while functional on Solana, is not as specialized for CEX-like performance as Hyperliquid's custom L1. Its pool-based liquidity model also offers a different set of risks and rewards for LPs compared to Hyperliquid's order book-focused HLP system.

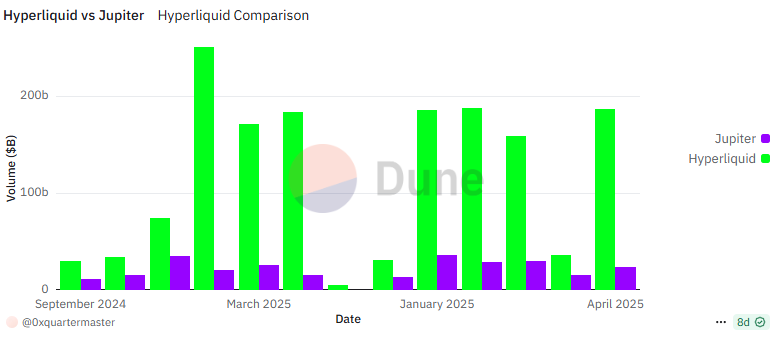

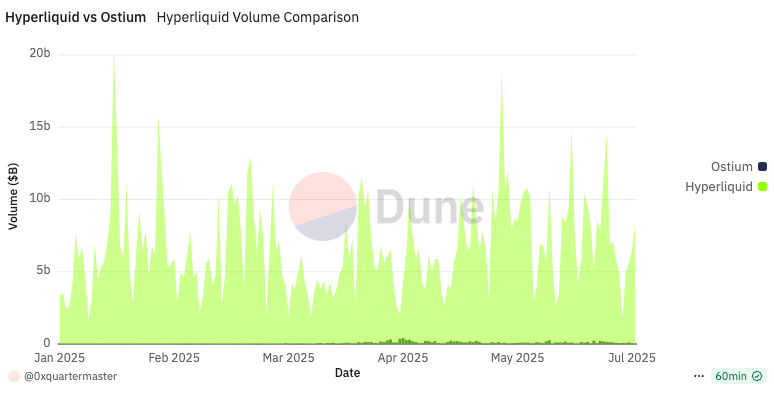

Trading Volume and OI Comparison with Hyperliquid

Incentives & Community Sentiment:

Jupiter's incentive structure is multi-faceted, primarily benefiting JLP holders and JUP token stakeholders rather than directly rewarding perpetual trading volume in the way some competitors do.

- JLP Rewards: Holders of the JLP token, who provide liquidity for the perpetuals market, receive 75% of all fees generated from Jupiter Perpetuals trading, token swaps, and JLP minting/burning. These fees are reinvested into the JLP pool, aiming to grow its value.

- JUP Tokenomics and Airdrops: The broader Jupiter ecosystem utilizes the JUP token. Jupiter has conducted retrospective airdrops to its user base. A significant portion of protocol revenue (50%) is designated for JUP token buybacks, with the purchased JUP being locked for three years. The JUP token has a maximum supply of 7 billion after a burn of 3 billion tokens, with current circulation around 38.5% and an inflation rate exceeding 40% projected for the next year due to vesting and a future airdrop.

- Community Sentiment and Risks: Jupiter is a cornerstone of the Solana DeFi ecosystem, and its success is closely tied to Solana's overall activity and prosperity. However, concerns exist regarding its aggressive expansion into multiple product lines (aggregator, LST, launchpad, wallet, perps, etc.), the effectiveness of some acquisitions like Moonshot, and the fact that its spot liquidity relies on partners like Meteora (which has its own token plans) rather than a proprietary pool whose fees would directly benefit JUP. The sustainability of its revenue, particularly from derivatives which form its main income, in a potential bear market or if Solana's current hype cycle cools, is also a consideration, especially given its current fee structure which might face pressure.

3.5 Vertex Protocol

Vertex Protocol offers a hybrid trading model that combines a CLOB with an AMM, integrating spot, perpetuals, and money markets into a unified platform.

Vertex emphasizes high performance, aiming for low-latency order matching (5-15 milliseconds) and leveraging an off-chain sequencer for its orderbook with on-chain settlement. A key component of its strategy is Vertex Edge, a synchronous orderbook liquidity product designed to unify cross-chain liquidity from various supported EVM-compatible chains (like Arbitrum, Blast via Blitz, Mantle, Sei, Base, Sonic, Abstract, Berachain via Bro.Trade, and Avalanche) into a single, shared layer.

Analysis Based on Key Performance Metrics

Liquidity Depth

Vertex Protocol constructs its liquidity through a hybrid model. At its core is an on-chain constant product AMM which also populates the off-chain sequencer's orderbook. This means trades can fill against limit orders from the CLOB and AMM LP positions concurrently, with the sequencer sourcing the best available price. The platform supports 50+ spot and perpetual pairs. Vertex Edge is crucial for liquidity depth, as it aggregates resting liquidity (maker orders) from all connected chains (Arbitrum, Blast, Mantle, Sei, Base, Sonic, Abstract, Berachain, Avalanche) into a synchronous, unified orderbook layer.

This design aims to provide deeper markets and tighter spreads by allowing, for example, a taker order on one chain to be matched with maker liquidity from another. Users can also provide passive liquidity to the AMM and earn trading fees. Vertex states its design allows for scalable liquidity to multiples of TVL. The upcoming Vertex Liquidity Pool (VLP) aims to further enhance liquidity by combining the order book model with automated liquidity pools, supporting spread trading, high-leverage pools, and long-tail assets.

Order Settlement Speed and Latency

Vertex utilizes an off-chain sequencer for order matching, which allows for very low latency, reported to be between 5-15 milliseconds. Matched orders are then batched and settled on-chain on Arbitrum (or the respective Edge-connected chain where the order originated). This hybrid model aims to provide CEX-like performance while retaining on-chain self-custody and settlement.

The sequencer initially operates as an independent node run by the Vertex team, with a stated TPS of 15K. In case of sequencer downtime, users can fall back to trading directly against the on-chain AMM, albeit with increased latency (referred to as "Slo-Mo Mode"). Oracles play a key role; Vertex employs a multi-oracle approach using Stork (an ultra-low-latency hybrid oracle network) for most markets and Chainlink Data Streams for others (like ETH markets) to secure liquidations, funding rates, and P&L calculations. Stork provides spot oracle prices, perpetual prices from CEXs, and the Vertex orderbook price, which are used for calculating funding and liquidation prices.

Market Makers (LPs) and Profitability

Market makers and liquidity providers are incentivized on Vertex through several mechanisms:

- Trading Fee Structure: Vertex offers zero trading fees for makers across all markets (0 bps). Takers are charged a low fee of 0.02% (2 bps). Vertex Edge instances share these fees; for a cross-chain match, the taker fee is charged on the taker chain, and a maker rebate (-0.005% or -0.5 bps) is applied on the maker chain, with some fee accruing to the maker chain.

- VRTX Staking for Rebates: Market makers can stake VRTX tokens to receive higher fee rebates, scaling up to 0.75 basis points.

- VRTX Trading Rewards: The "Trade & Earn" program distributes VRTX tokens to both makers (75% of the weekly pool) and takers (25% of the weekly pool) on a pro-rata basis relative to their activity within an epoch. These rewards are split between chains supported by Vertex Edge based on cross-chain reward calculations.

- AMM Liquidity Provision: Users can LP into the on-chain AMM and earn trading fees from trades that interact with their liquidity.

- Future VLP: The planned Vertex Liquidity Pool (VLP) will offer yield via spot/perps arbitrage for VLP holders and earn fees from trading and liquidation activity in high-leverage pools and long-tail asset markets. LPs in the AMM take on standard impermanent loss risk, while the overall system's risk is managed by an on-chain risk engine that handles cross-margined accounts. Liquidators are also incentivized by earning a portion of the liquidated assets.

Head-to-Head: Vertex Protocol/Perps vs. Hyperliquid Comparison Matrix

| Feature / Aspect | Vertex Protocol/Perps's Approach | Hyperliquid's Approach | Comparative Rating |

|---|---|---|---|

| Orderbook/Execution | Hybrid: Off-chain CLOB sequencer (5-15ms latency) for matching, on-chain settlement on Arbitrum (and Edge-connected chains). On-chain AMM backstop. Vertex Edge unifies liquidity across multiple EVM chains. | Fully on-chain orderbook (HyperCore) on a custom L1. | Different Trade-off |

| Trading Fees | Makers: 0% (zero fees). Takers: 0.02% (2 bps). Maker rebates up to -0.0075% via VRTX staking. Sequencer fees for some operations (e.g., 1 USDC for liquidation submission). | Taker: 0.045% (VIP 0, under $5M volume); Maker: 0.015% (VIP 0). VIP tiers offer lower fees for higher volumes. | Better |

| Incentive Program | VRTX "Trade & Earn": 75% of epoch rewards to makers, 25% to takers. VRTX staking for Fee APY (from revenue buybacks), Base APY (emissions), Loyalty APY (early unstake penalties), and maker rebates. | Points for trading activity, referrals. Past cash rewards for volume/holding (e.g., $1 for $10k volume). | More Effective |

| Liquidity Depth (Majors) | Hybrid CLOB + AMM. Vertex Edge aggregates maker liquidity from multiple connected chains (Arbitrum, Blast, Mantle, Sei, Base, Sonic, Abstract, Avalanche, Berachain) into a single synchronous orderbook. Future VLP planned. | HLP vault (USDC deposits) for democratized, protocol-managed algorithmic market making directly on the orderbook across all assets. | Different Trade-off |

| Asset Variety | 50+ spot and perpetual pairs including crypto majors, altcoins, and GMCI 30 & MEME Indices. Vertex Edge allows native spot asset trading between chains. | Rapid listing of new and trending assets, reportedly 100+ assets available. | Worse |

| User Experience (UI/UX) | Off-chain sequencer enables fast (5-15ms) order matching and CEX-like features (e.g., multiple subaccounts, one-click trading). Cross-chain deposits via Axelar. Operates on Arbitrum and other EVM chains via Edge. | Custom L1 designed for CEX-like speed, high order throughput (200,000 orders/second), one-block finality, and potentially gasless transactions. Unified experience. | Equally Good |

| Liquidation Engine | Liquidations occur at mark oracle price (Stork/Chainlink) when maintenance health < 0. Liquidators take over positions, paying a discount; 50% of profit goes to insurance fund. Insurance fund as backstop; then socialized losses. | HLP vault acts as a liquidation backstop, with PnL from such activities shared with HLP depositors. | Different Trade-off |

Analysis of Findings & Critical Weaknesses

Vertex Protocol, with its hybrid architecture and ambitious Vertex Edge cross-chain liquidity solution, presents a sophisticated alternative in the DEX perpetuals market. However, when benchmarked against Hyperliquid, several key differences and potential weaknesses emerge:

- Orderbook/Execution (Different Trade-off): Vertex's off-chain sequencer combined with on-chain settlement provides very low latency (5-15ms) for order matching. Vertex Edge aims to unify liquidity across multiple EVM chains, which is a powerful concept for aggregating depth. However, this model relies on the sequencer's uptime and eventual decentralization to mitigate centralization concerns. The trade-off lies between Vertex's potential cross-chain liquidity aggregation and current sequencer model versus Hyperliquid's vertically integrated single-chain high performance.

- Trading Fees (Better): Vertex appears to have a more competitive fee structure for active traders. Its 0 bps maker fee and 2 bps taker fee are compelling. With VRTX staking, makers can even receive rebates up to -0.75 bps. While Vertex has sequencer fees for certain actions like withdrawals or liquidations, its core trading fees are highly competitive.

- Incentive Program (More Effective): Vertex's VRTX "Trade & Earn" program directly rewards both makers (75%) and takers (25%) with VRTX emissions. Furthermore, staking VRTX offers multiple yield sources including protocol revenue buybacks (Fee APY), emissions (Base APY), and penalties from early unstakers (Loyalty APY), alongside maker rebates. This multi-faceted approach to rewarding active participation and long-term staking appears more developed and potentially more sustainable in driving diverse user behaviors.

- Liquidity Depth (Majors) (Different Trade-off): Vertex Edge's core value proposition is aggregating liquidity from multiple chains into a single orderbook. This could theoretically lead to very deep markets if successfully implemented across many active chains. Hyperliquid's HLP model centralizes liquidity provision into its own protocol-managed vault, democratizing market-making. Vertex's success here depends on the adoption and activity on its various Edge instances, while Hyperliquid's depends on the capital attracted to HLP and the efficacy of its strategies. The "future VLP" for Vertex suggests plans to further bolster on-chain liquidity directly.

- Asset Variety (Worse): Vertex lists over 50 spot and perpetual markets, including innovative crypto indices like GMCI 30, a market-cap weighted blue-chip index, and MEME, an index tracking popular memecoins. While diverse, this is fewer than Hyperliquid's reported 100+ rapidly listed assets. Hyperliquid’s focus on quickly onboarding a wide array of new and trending tokens gives it an edge for traders seeking early exposure to a larger selection of assets.

- User Experience (UI/UX) (Equally Good): Both platforms aim for a CEX-like experience. Vertex achieves this through its fast off-chain sequencer, features like one-click trading, and multiple subaccounts. Hyperliquid's custom L1 is built for speed and high throughput natively. Vertex’s multi-chain nature via Edge, while powerful, might introduce some UX complexity compared to Hyperliquid's single-chain environment, but its interface aims for feature-richness. Both offer compelling, high-performance environments.

- Liquidation Engine (Different Trade-off): Vertex uses oracle prices for liquidations, with liquidators stepping in and a portion of their profit funding an insurance pool; socialized losses are a last resort. Hyperliquid's HLP also plays a role in backstopping liquidations, intertwining its liquidity provision with market stability. The key difference is the primary mechanism and beneficiary of the liquidation process; Vertex relies on external liquidators and an insurance fund, while Hyperliquid involves its liquidity providers more directly.

Vertex's main challenge relative to Hyperliquid might be the complexity and reliance on the successful scaling and adoption of its Vertex Edge concept across many chains to realize its full liquidity potential. While its fee structure and incentive programs are strong, its current asset variety is less extensive. Hyperliquid's advantage lies in its focused, vertically integrated L1 solution that rapidly onboarded users and assets with a simple, high-performance offering.

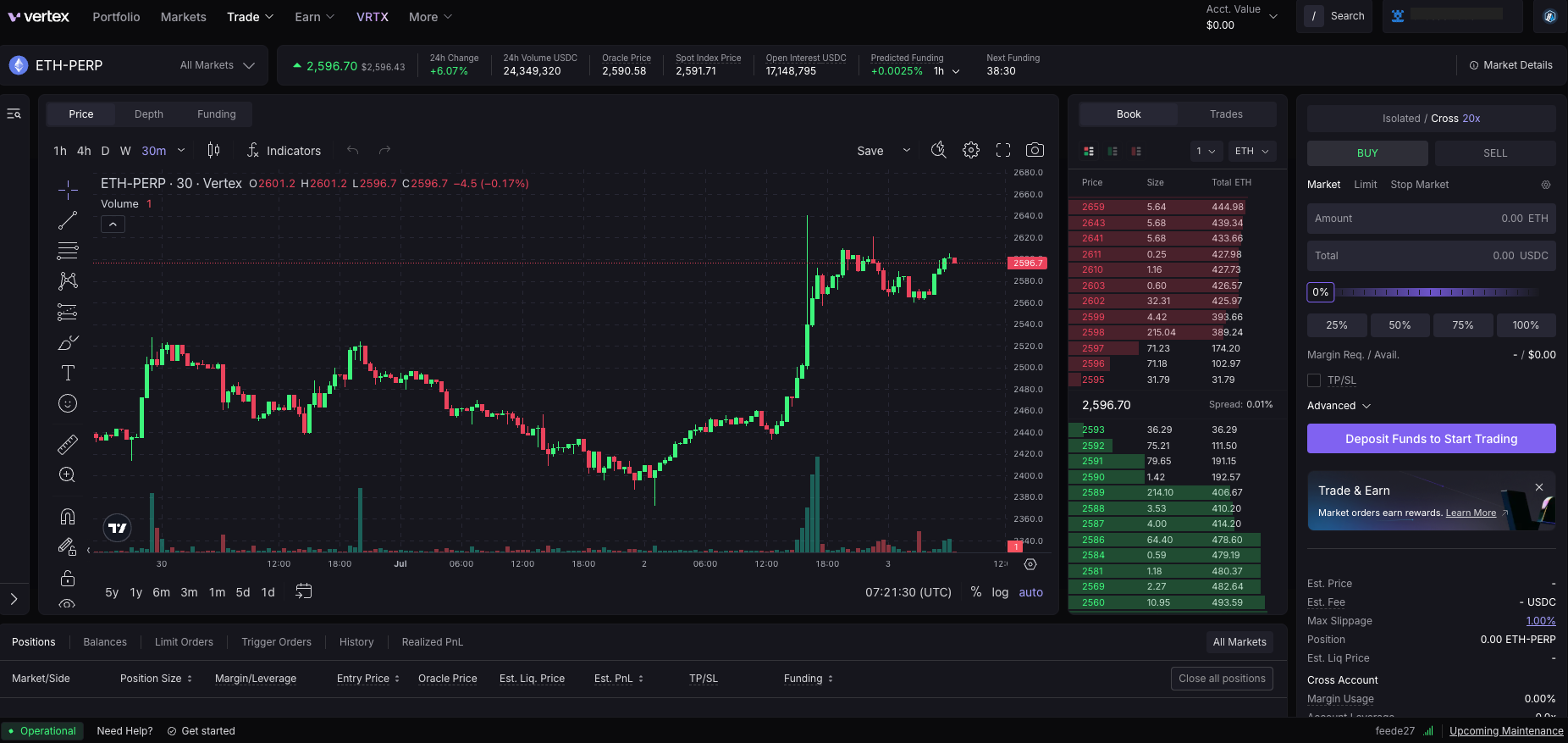

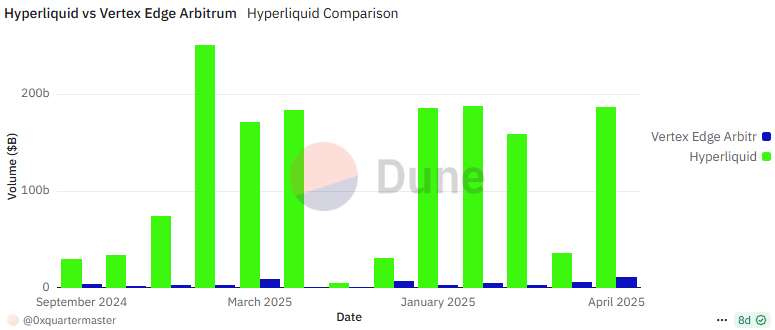

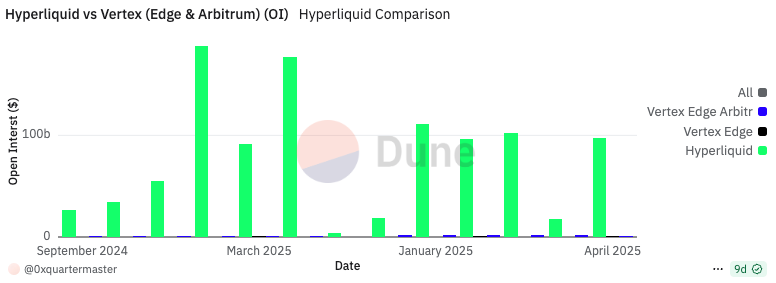

Trading Volume & OI Comparison with Hyperliquid

Incentives & Community Sentiment:

Vertex Protocol employs a multifaceted incentive strategy centered around its VRTX token and the Vertex Edge ecosystem:

- VRTX Trading Rewards (Trade & Earn): A significant portion of the VRTX token supply (34% or 340 million VRTX) is allocated to ongoing trading incentives, distributed weekly over 72+ epochs (each 7 days). 75% of these rewards go to makers and 25% to takers, distributed pro-rata based on activity within each epoch across all Edge-supported chains. Initially, emissions were higher but were reduced by 50% in September 2024 to align with long-term strategy.

- VRTX Staking: Staking VRTX provides several benefits:

- Base APY: From VRTX emissions, starting at 15% annualized and tapering to 1.5% over three years.

- Fee APY: Derived from protocol revenue. Initially, 50% of all protocol fees are used to buy back VRTX and add it to the staking pool, gradually increasing to 100% of total protocol revenue.

- Loyalty APY: Penalties (10%) from users who unstake VRTX before a 21-day cooldown period are redistributed to remaining stakers. Rewards are auto-compounded.

- Maker Rebates via Staking: Market makers who stake VRTX can receive fee rebates, scaling up to 0.75 basis points, enhancing incentives for liquidity provision.