Unveiling Hyperliquid: The $HYPE-Driven, Data-Backed Path to Perpetual Dominance

John Doe

12 Jun 2025

Commanding over 60% of the decentralized perpetuals trading volume, one decentralized exchange is not just outmaneuvering its peers but is generating revenues that eclipse giants. Is this a fleeting anomaly, or the dawn of a new DEX supremacy engineered from first principles? Hyperliquid has electrified decentralized finance by seamlessly blending the raw power of a dedicated Layer 1 blockchain with the polished efficiency of a top-tier centralized exchange. This potent combination has allowed it to attract a massive user base and generate staggering revenue streams—earning over 30 times more in annualized revenue than its closest competitor, GMX—fundamentally challenging the established order. But Hyperliquid is more than just impressive trading volumes; its native $HYPE token underpins a sophisticated economic engine designed for utility and value accrual through innovative staking mechanisms and aggressive buyback programs. This analysis dissects the numbers behind Hyperliquid's meteoric rise, from its staggering revenue and utility-driven tokenomics to the market-defining metrics and innovations that position it to reshape the future of decentralized trading.This piece explores:

- Hyperliquid’s high-octane revenue engine and its standing against competitors.

- The evolution of $HYPE staking and its tangible benefits to users.

- A comparative analysis of Hyperliquid's market dominance in volume and Open Interest.

- The direct impact of $HYPE buybacks and burns on token value.

- Key technological advancements cementing its leadership.

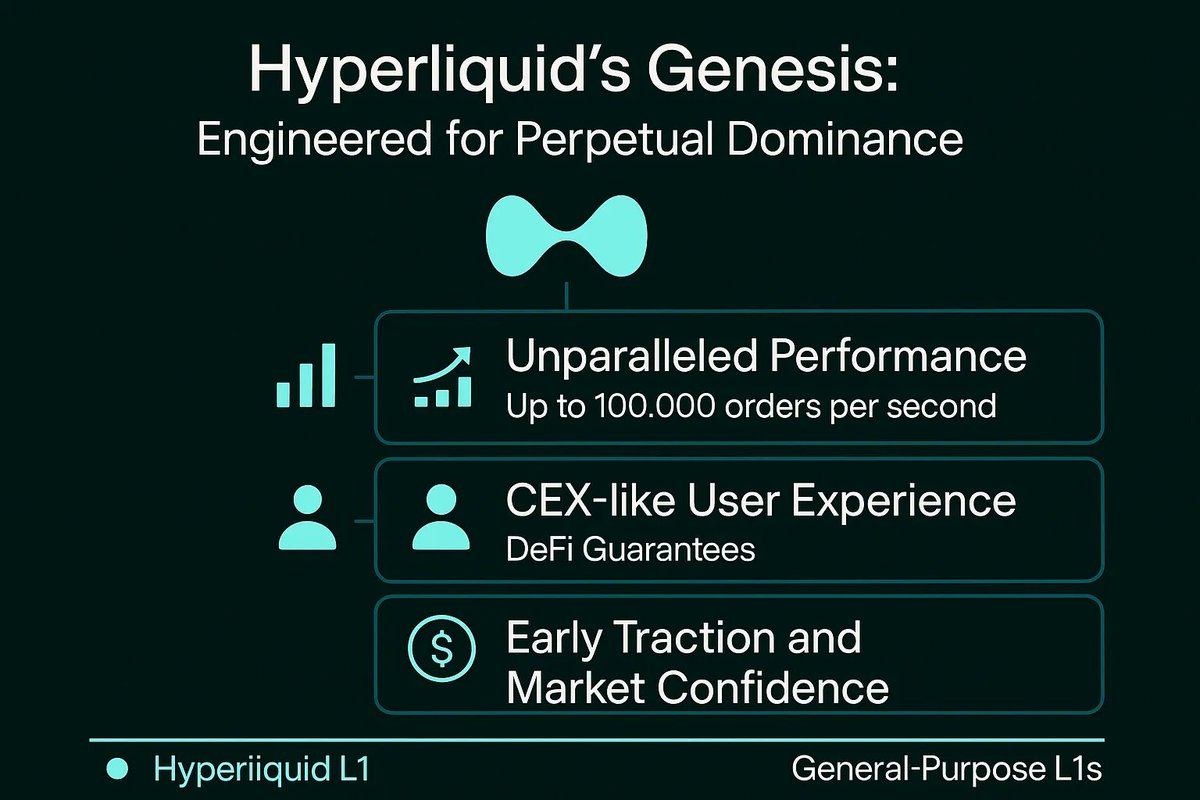

Hyperliquid's Genesis: Engineered for Perpetual Dominance

Understanding the complex needs of sophisticated traders, Hyperliquid was engineered to deliver speed, reliability, and a superior user experience without compromising on the core tenets of decentralization. At its heart lies a purpose-built Layer 1 blockchain, meticulously engineered to support a high-throughput decentralized perpetual exchange.

- Unparalleled Performance: The Hyperliquid L1 boasts impressive capabilities, processing up to 100,000 orders per second with sub-second latency. This allows for on-chain order book management that rivals the responsiveness of CEXes, a critical factor for derivatives trading where timing is paramount.

- CEX-like User Experience, DeFi Guarantees: Hyperliquid has masterfully fused the operational efficiency and refined user interface typical of CEXs with the transparency and self-custody inherent to decentralized systems. This includes abstracting gas fees for trading activities, presenting a simplified and predictable cost structure for users.

- Early Traction and Market Confidence: This unique architecture quickly garnered significant attention, translating into substantial trading volumes and a rapidly growing user base even before the full ecosystem effects of its native token and EVM compatibility were realized.